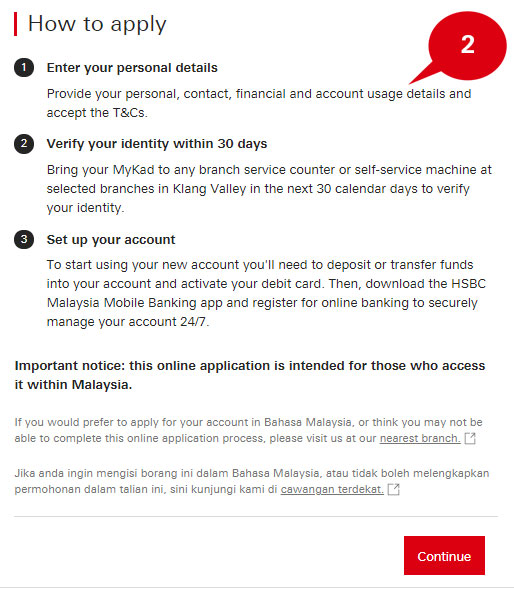

3 steps to opening a new bank account online with us

- ApplyComplete a simple 5-step application form and receive a confirmation email within 10 minutes.

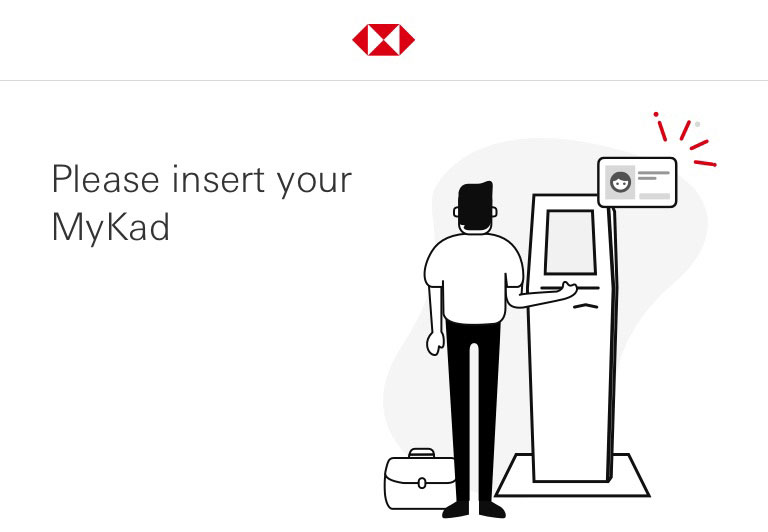

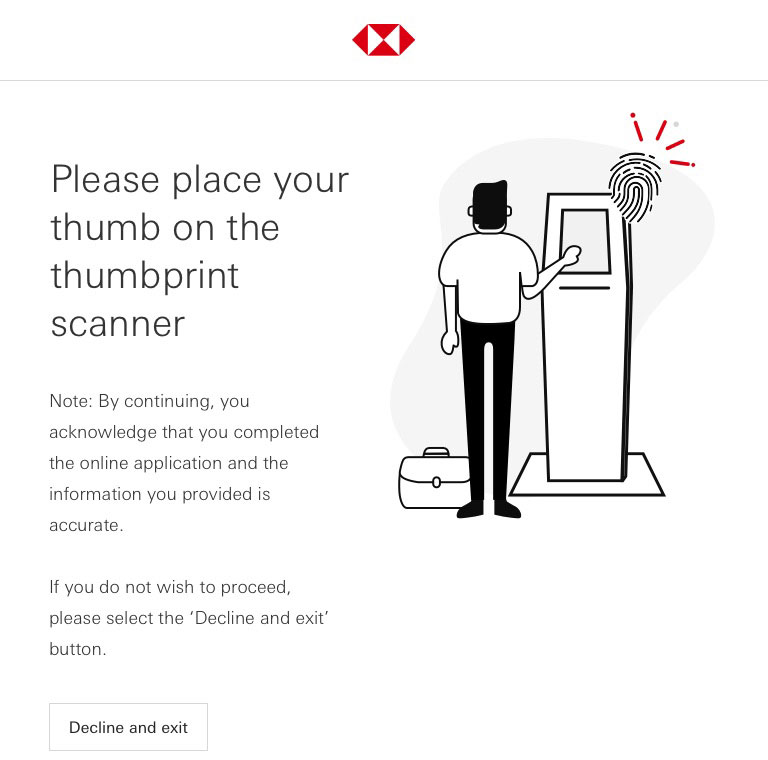

- AuthenticateConfirm your identity at our branch service counters or at the Self-Service Machines which are available 24/7 at selected branches in Klang Valley. Please bring your MyKad along for authentication purpose.

- ActivateYour debit card will be sent by post or you may request it at any HSBC branch. Then, activate your debit card and register for online banking to enjoy banking on the go.

To get started, let's find the right accounts for you

HSBC Everyday Global Account

- Open in Ringgit Malaysia and access 10 additional foreign currencies in one account*

- Enjoy convenient 24/7 currency conversions with real-time exchange rates via online and mobile banking*

- Make foreign currency purchases and cash withdrawals overseas from your account directly with your HSBC Everyday Global Visa Debit Card

(i) Eligibility criteria apply

No minimum balance requirement

HSBC Premier Everyday Global Account

Additional benefits

- Get your family* recognised as an HSBC Premier customer worldwide.

- Open an overseas account* while you are in Malaysia & make fee-free, instantaneous global money transfer*.

- We are ready to assist all levels of investors to achieve your financial goals with our Wealth Specialist and services.

(i) Eligibility:

Total Relationship Balance2 of RM200,000 or more.

HSBC Advance Everyday Global Account

Additional benefits

- Advance Managers to help plan your financial goals

- Instant global transfers1 between HSBC accounts worldwide

- Priority service for branch counter services

(i) Eligibility criteria apply

Min Total Relationship Balance2 of RM30,000 or sign up for an HSBC Home Loan of RM300,000 and above

Basic Savings Account

- A no-frills savings account of which interest is calculated daily and paid monthly

- No monthly account fee

- 8 complimentary ATM transactions per month at any of our ATM machines

- Easy access to complimentary monthly e-statement, fund transfer and bill payment via HSBC Online and Mobile Banking

(i) Eligibility criteria apply

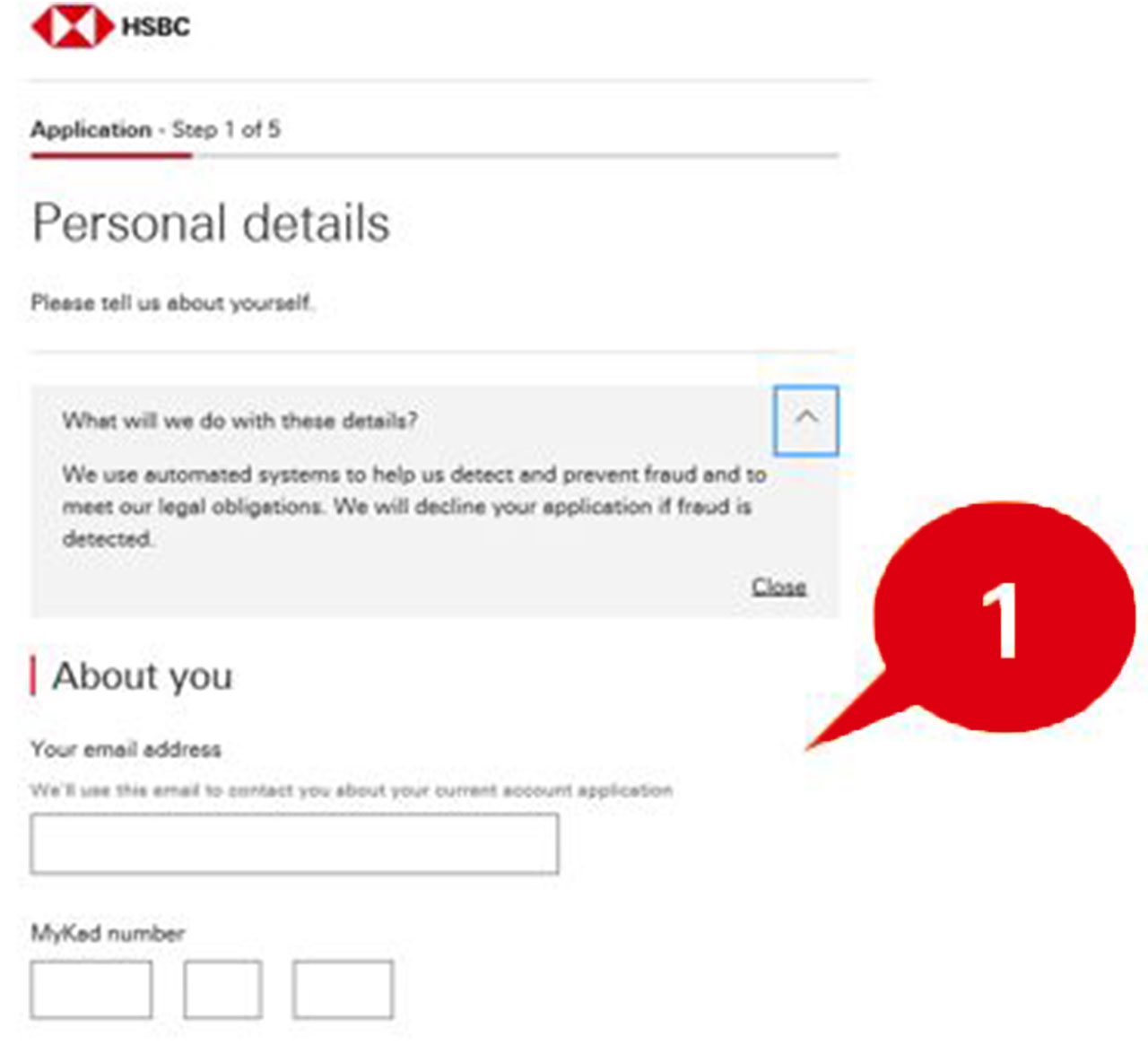

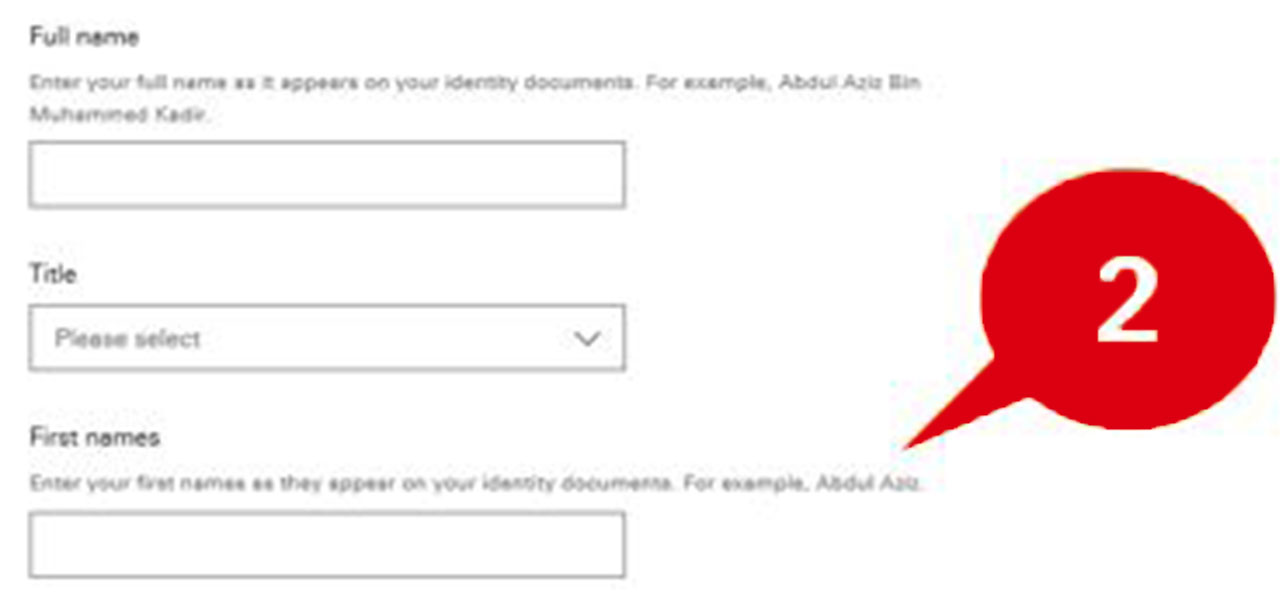

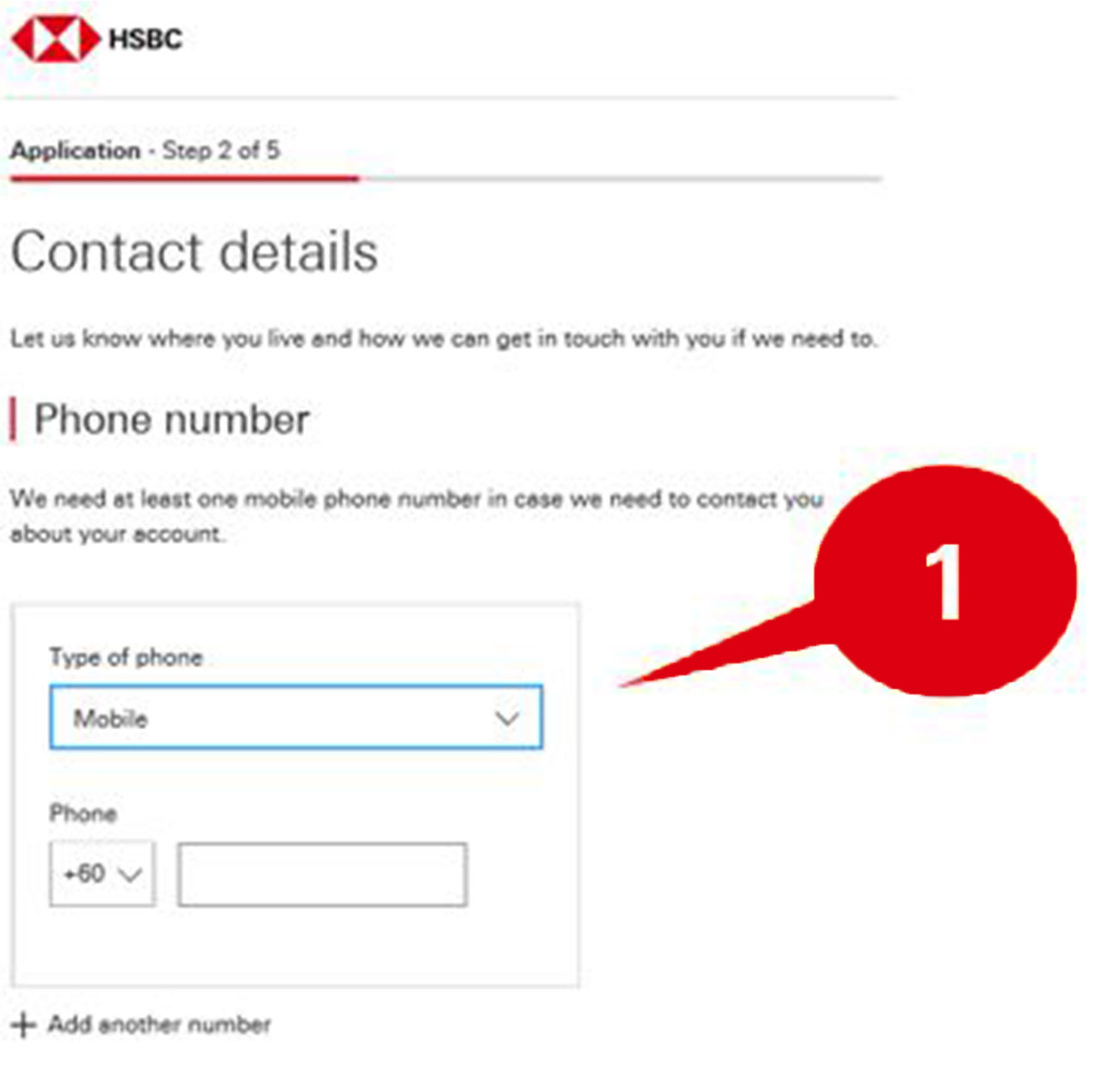

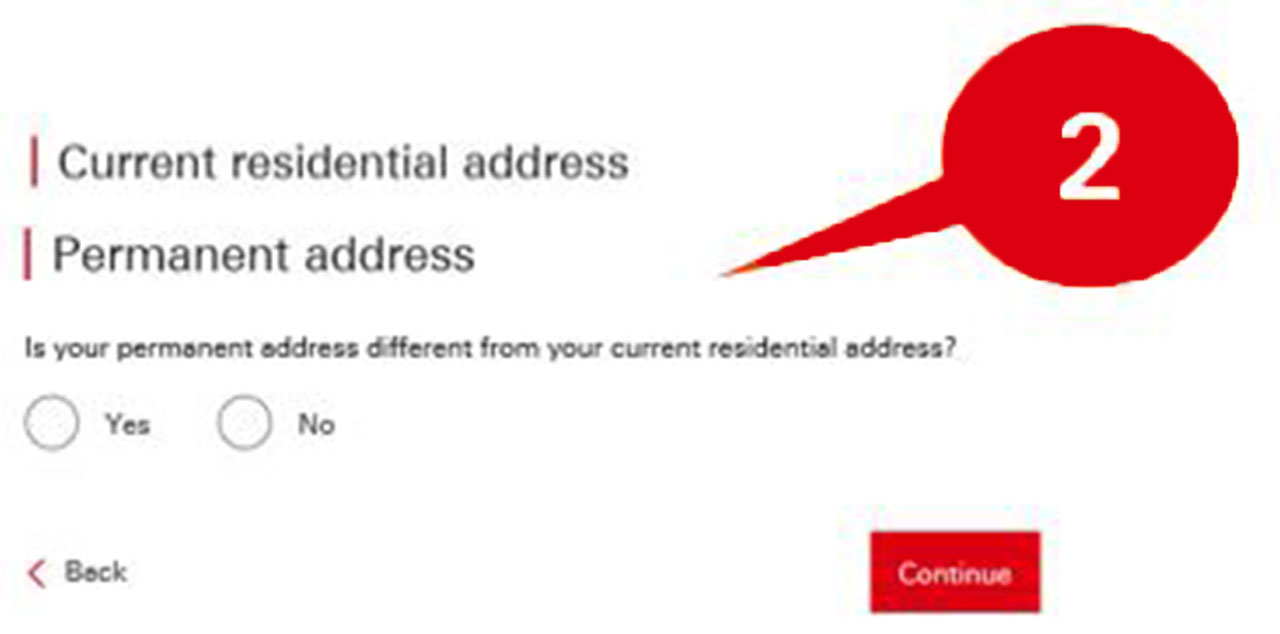

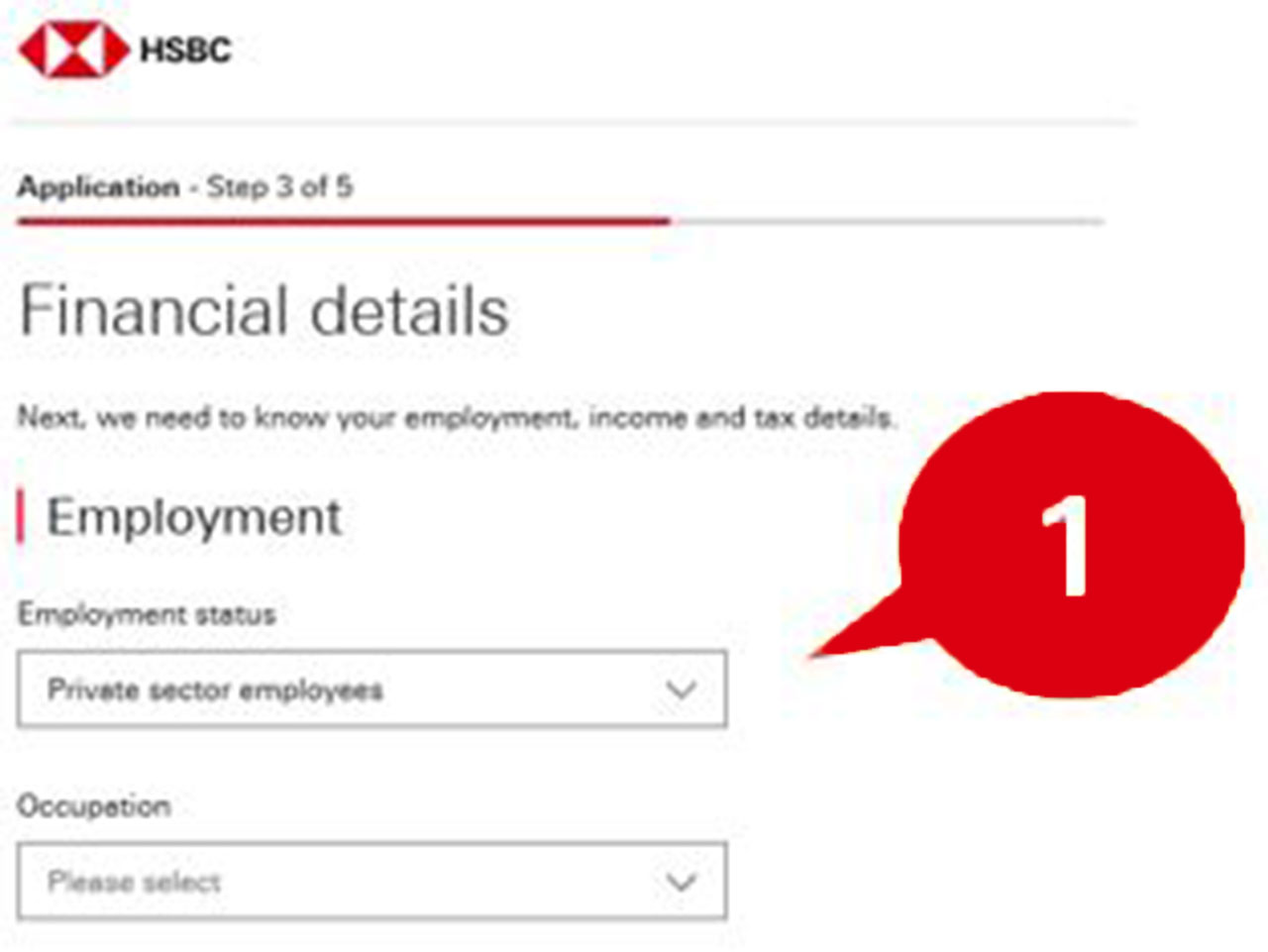

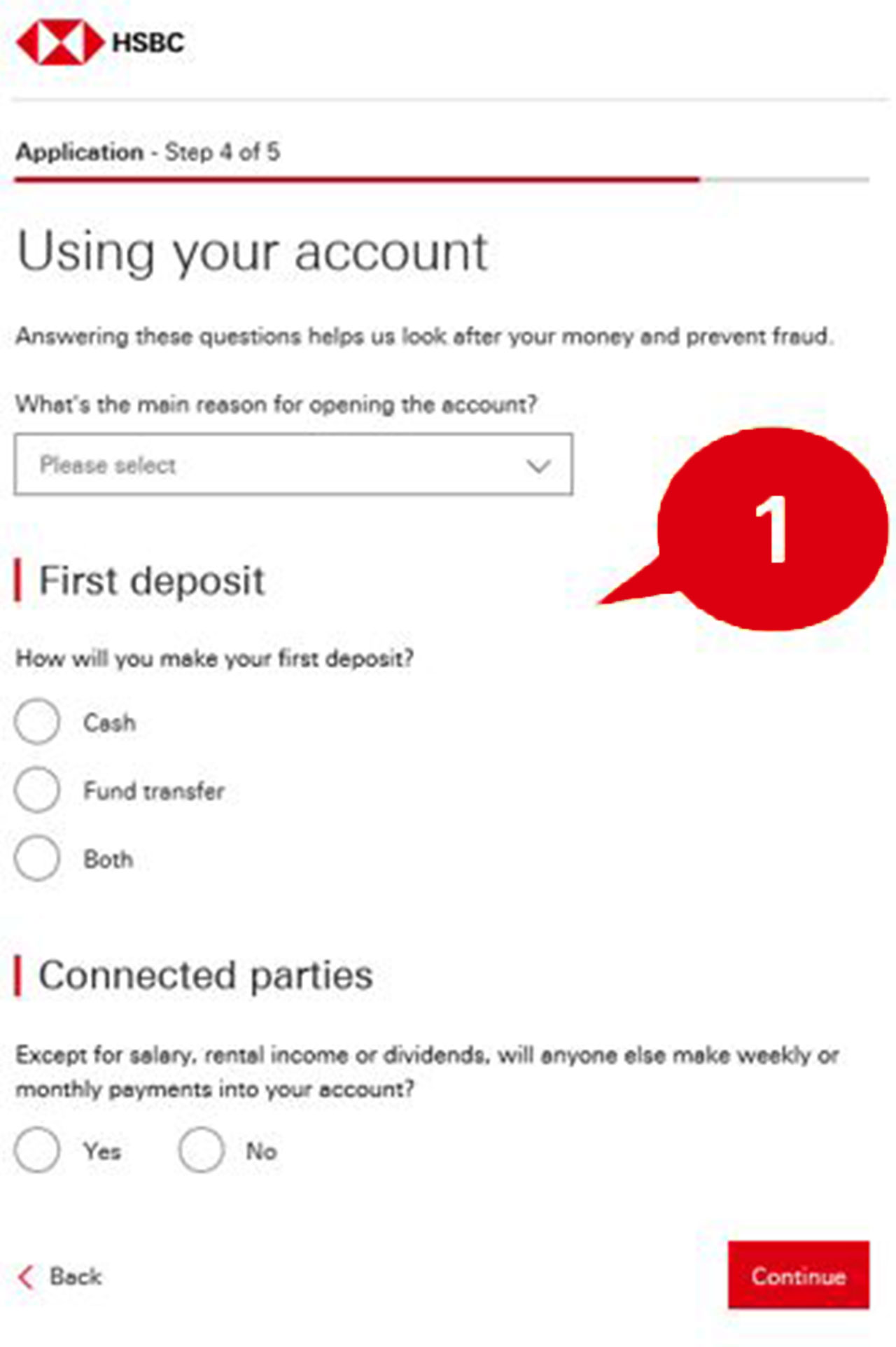

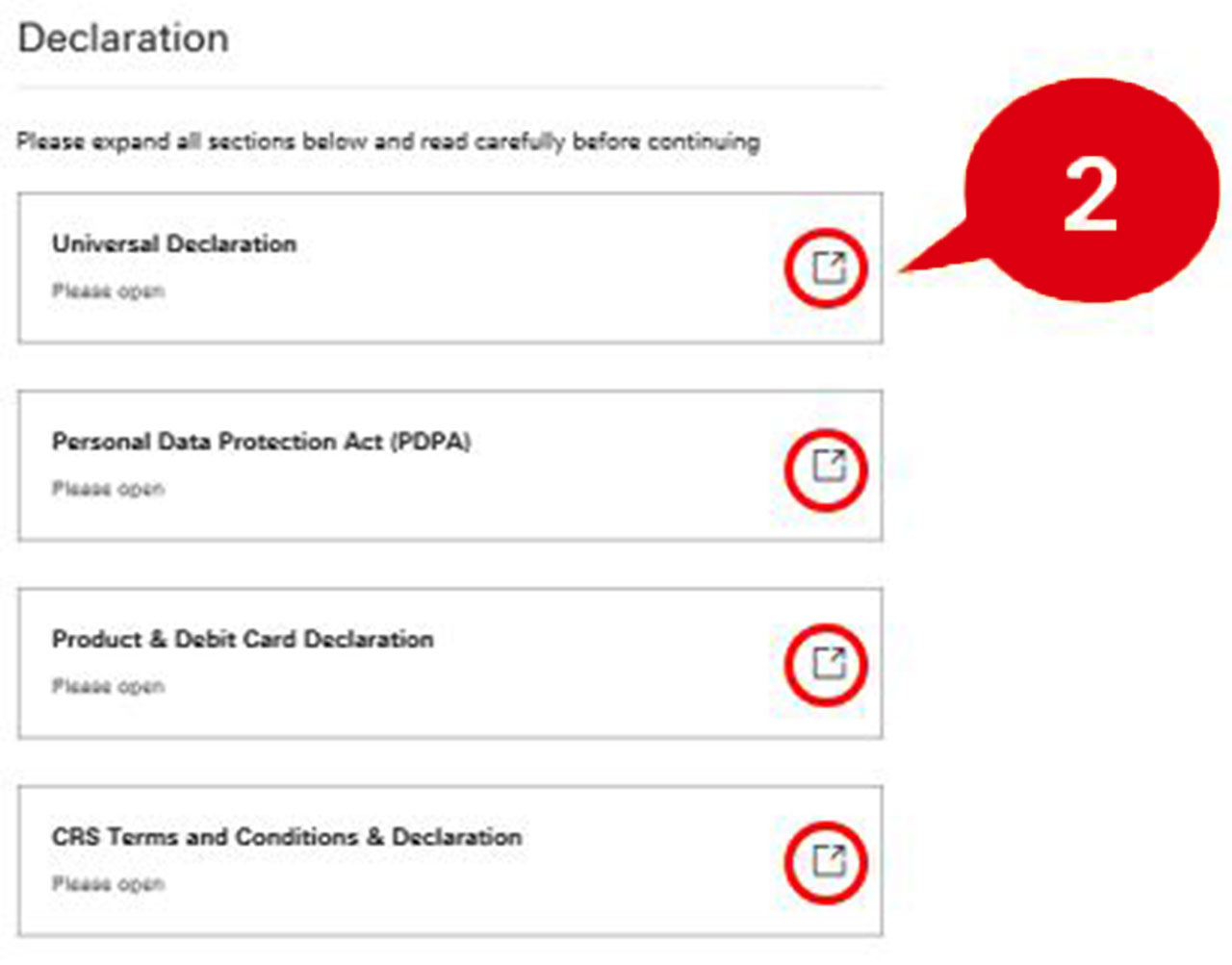

Tips to complete your online application form

Tips to completing biometric verification at Self-Service Machines

Self-Service Machines are available in the self-service lobby at branches below:

- HSBC Kepong

- HSBC KL Main

- HSBC Klang

- HSBC Petaling Jaya

- HSBC Subang Jaya

- HSBC Amanah Bangsar

- HSBC Amanah Cheras South

- HSBC Amanah Kota Damansara

- HSBC Amanah Maluri

- HSBC Amanah Wangsa Maju

For other locations, you may find your nearest HSBC or HSBC Amanah branch here.

Click here to find out the next steps should you encounter issues during biometric verification at Self-Service Machines.

Things you should know

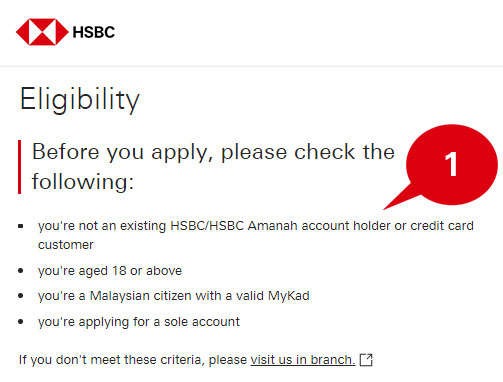

- Before you apply online, please check the following:

- You're not an existing HSBC customer or HSBC Amanah customer

- You're aged 18 or above

- You're a Malaysian citizen with a valid MyKad

- You're applying for a sole account

- If you don't meet these criteria, please visit us in branch - Member of Perbadanan Insurans Deposit Malaysia

Protected by Perbadanan Insurans Deposit Malaysia up to RM250,000 for each depositor*

*Click here for more details on PIDM protection.