Enjoy instant cash relief for your temporary needs

Nothing beats being cash ready in unannounced situations, especially when you're travelling. With cash advance on your HSBC credit card, your temporary financial needs can be instantly covered anytime and anywhere.

Benefits

- Financial flexibilityUseful for emergencies or when credit card payment is not accepted

- Quick cashNo documents required

- Easy accessInstant cash withdrawal from ATMs worldwide, 24 hours a day*

How to get cash advance from HSBC credit card

Any ATMs worldwide

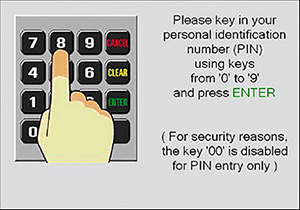

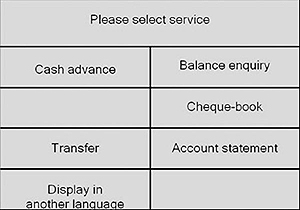

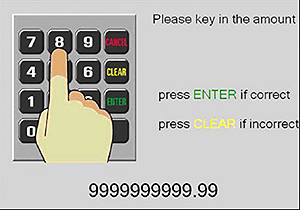

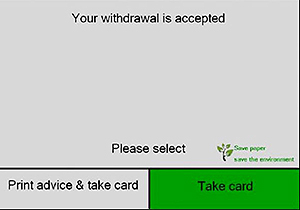

You can withdraw cash advance from HSBC or other banks' ATMs* using your credit card (PIN required).

Online transfer

If you have an HSBC deposit account, you can perform money transfer online from your HSBC credit card account to your HSBC savings or current account, 24 hours a day, 7 days a week*.

Step 1: Log on with username and password.

Step 2: Select 'Other Transfers' and choose 'Make a Transfer'.

Step 3: Select your credit card account to transfer the funds from, then select an amount to transfer your funds.

Step 4: Enter the amount you would like to withdraw and click 'Transfer' button.

Phone

To apply, call 1300-88-1388 (local callers) or +603-832-5400 (oversea callers). Cash can be immediately transferred to your HSBC current or savings account.

Things you should know

Issued by HSBC Bank Malaysia Berhad Company No. 19840105221 (127776-V).

*Cash advances will be subject to a cash advance fee of 5% of the amount advanced or RM15.00 ( and applicable tax, if any), whichever is higher. In addition to this cash advance fee, cash advances from the HSBC Group’s ATMs and Visa/Plus System and MasterCard/Cirrus ATM Networks are subject to handling charges which are determined by HSBC Bank at its absolute discretion and notified to the Cardholder in such manner as HSBC Bank deems fit. The cash advance fee and any applicable handling charges shall be debited to the Card Account as at the date of the cash advance. The Finance Charge shall be charged at a fixed rate of 18% per annum on the Cash Advances amount taken, calculated from the date of disbursement until payment in full. The maximum amount that can be withdrawn from the Card Account by way of Cash Advance will depend on the prevailing limit set by HSBC Bank from time to time. Where the Cash Advance is made via ATM, each Cash Advance will be subjected to the applicable daily withdrawal limit or the withdrawal limit per Cash Advance transaction of the ATM. For more information, please refer to HSBC Tariff and Charges (PDF).

Discover more credit card features

Balance Conversion

Convert your retail transactions or balances to affordable monthly instalments.

Balance Transfer Instalment (BTI)

Consolidate all of the outstanding balances from your other credit cards to your HSBC credit card.