What is a Balance Conversion Plan?

A Balance Conversion Plan (BCP) lets you convert your credit card purchases into a monthly instalment plan at a more affordable rate. You can now apply for a BCP in the HSBC Malaysia Mobile Banking App too.

Benefits

- Financial flexibility (instalments of up to 36 months)

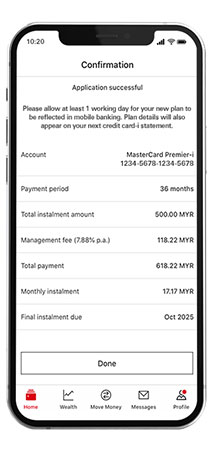

- Instant approval

- Lower interest rate

- No early termination fee

New to online banking?

Download and apply via HSBC Malaysia app

How to apply for a BCP

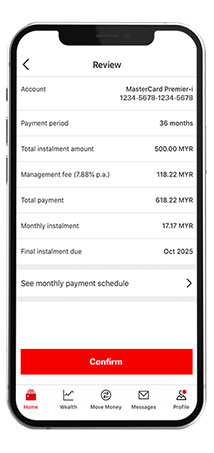

Apply in 3 easy steps:

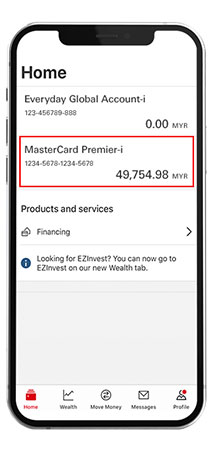

- Log on to the HSBC Malaysia app.

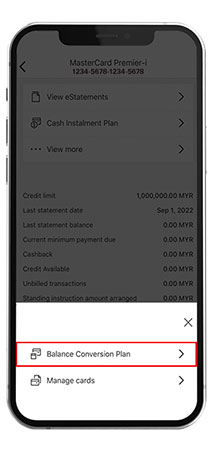

- Select your credit card and then tap on "Balance Conversion Plan'.

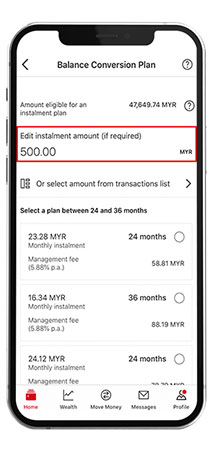

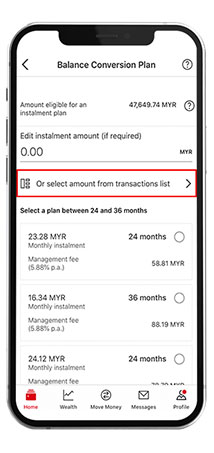

- Key in an amount or select available transactions which you'd like to convert to an instalment.

How does a BCP credit card instalment plan work?

Balance conversion amount (RM) 7.88% p.a.* |

6 months |

12 months |

24 months |

36 months |

|---|---|---|---|---|

| 500 |

86.62 |

44.95 |

24.12 |

17.17 |

| 3,000 |

519.70 |

269.70 |

144.70 |

103.03 |

| 5,000 |

866.17 |

449.50 |

241.17 |

171.72 |

| 15,000 |

2,598.50 |

1,348.50 |

723.50 |

515.17 |

Balance conversion amount (RM) 7.88% p.a.* |

500 |

|---|---|

| 6 months |

86.62 |

| 12 months |

44.95 |

| 24 months |

24.12 |

| 36 months |

17.17 |

Balance conversion amount (RM) 7.88% p.a.* |

3,000 |

| 6 months |

519.70 |

| 12 months |

269.70 |

| 24 months |

144.70 |

| 36 months |

103.03 |

Balance conversion amount (RM) 7.88% p.a.* |

5,000 |

| 6 months |

866.17 |

| 12 months |

449.50 |

| 24 months |

241.17 |

| 36 months |

171.72 |

Balance conversion amount (RM) 7.88% p.a.* |

15,000 |

| 6 months |

2,598.50 |

| 12 months |

1,348.50 |

| 24 months |

723.50 |

| 36 months |

515.17 |

Who's eligible for a BCP?

- HSBC / HSBC Amanah principal credit cardholders.

- Active primary credit card account holders with no overdue payments or overdrawn balances.

- Credit card account holders with outstanding balances of RM500 and above.

Frequently Asked Questions

You may also be interested in

Cash Advance

Use cash advance for instant cash relief.

Balance Transfer Instalment (BTI)

Consolidate all of the outstanding balances from your other credit cards to your HSBC credit card.

Cash Instalment Plan

Convert your available credit limit into instant cash.

Card Instalment Plan

Enjoy 0% interest instalment.

Things you should know

Issued by HSBC Bank Malaysia Berhad Company No. 198401015221 (127776-V).

*The eligible amount for each Balance Conversion Plan ("BCP") is at a minimum of RM500 and a maximum of RM50,000. The Eligible Cardholder shall pay 100% of the BCP monthly instalment which is part of the Minimum Monthly Payment due on or before the payment due date. The interest rate offered is subject to HSBC's approval. The terms used herein are as defined in the HSBC Balance Conversion Plan Terms and Conditions.