Discover your personal level of risk tolerance

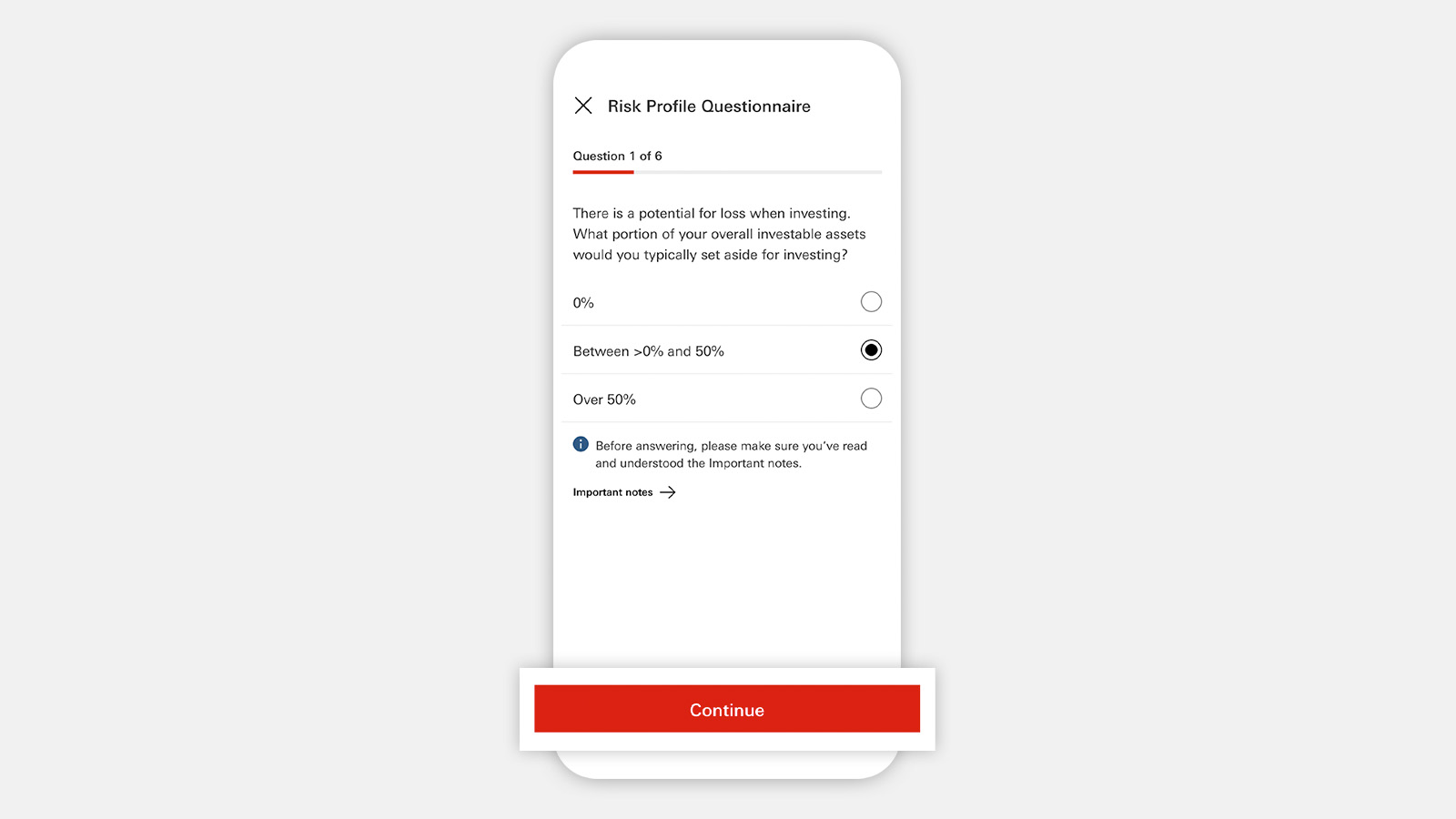

The Risk Profile Questionnaire (RPQ) uses 6 questions to assess your personal risk tolerance. Based on your responses, you'll get a risk tolerance rating from 0 to 5, with 0 being risk averse and 5 being speculative or comfortable with risk.

With your RPQ result, you can explore investment opportunities that align with your goals, while maintaining a risk level that you're comfortable with.

Why you should know your investment risk profile

How to take the Risk Profile Questionnaire (RPQ)

Follow these steps to find your personal risk tolerance level.

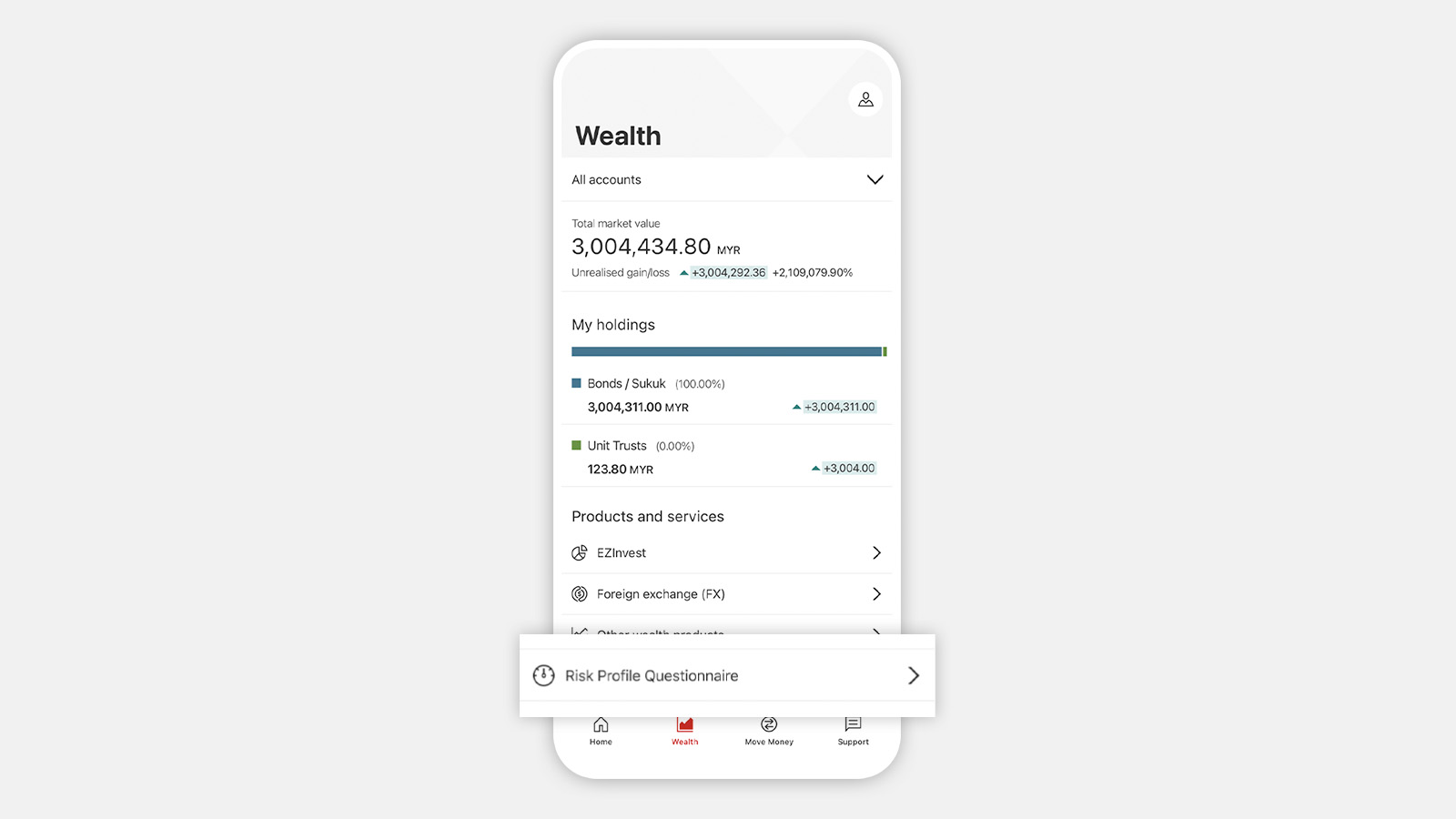

Step 1: Log on to the HSBC Malaysia Mobile Banking app

Step 2: Complete the Risk Profile Questionnaire

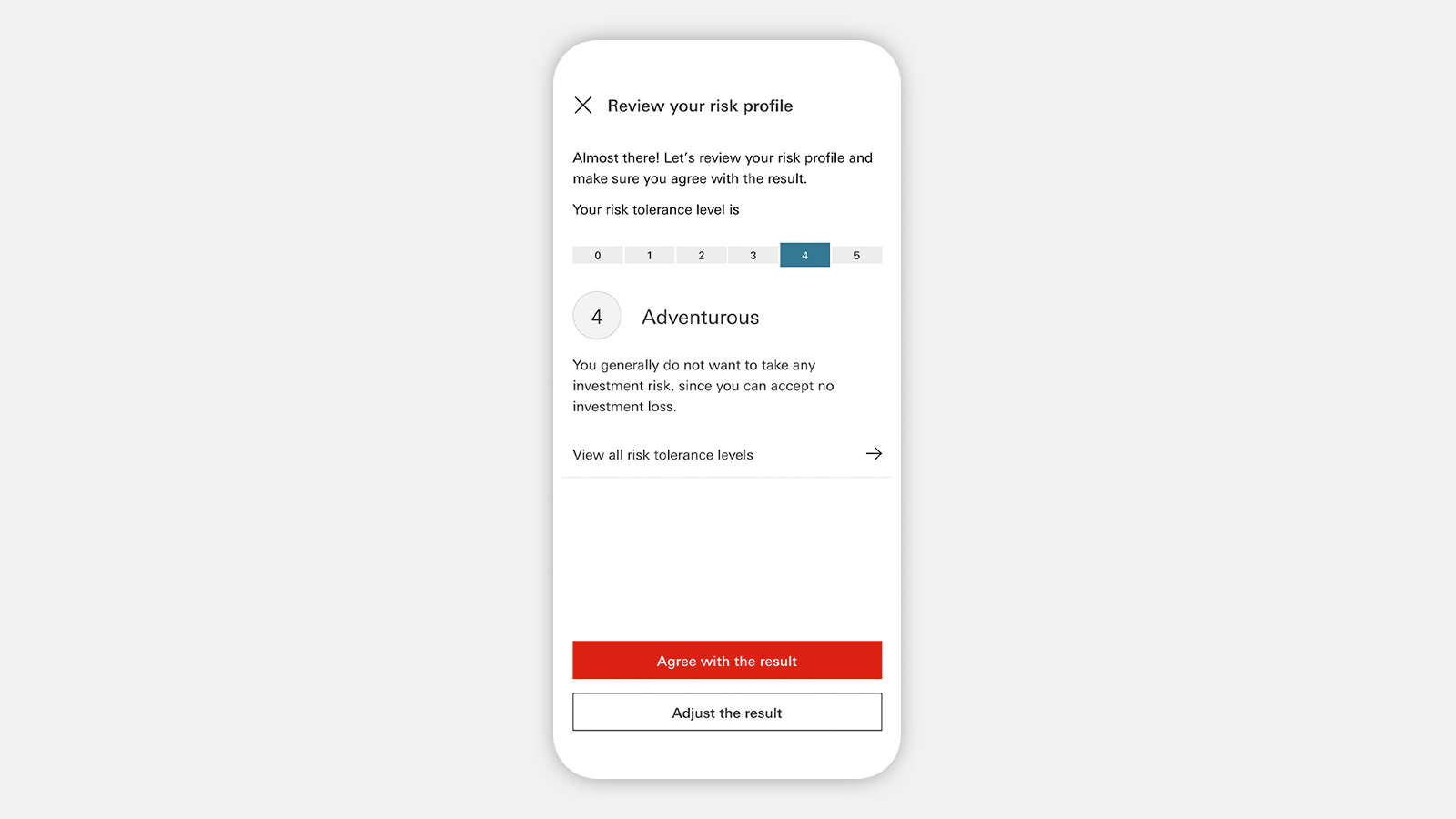

Step 3: Review your Risk Profile Questionnaire results

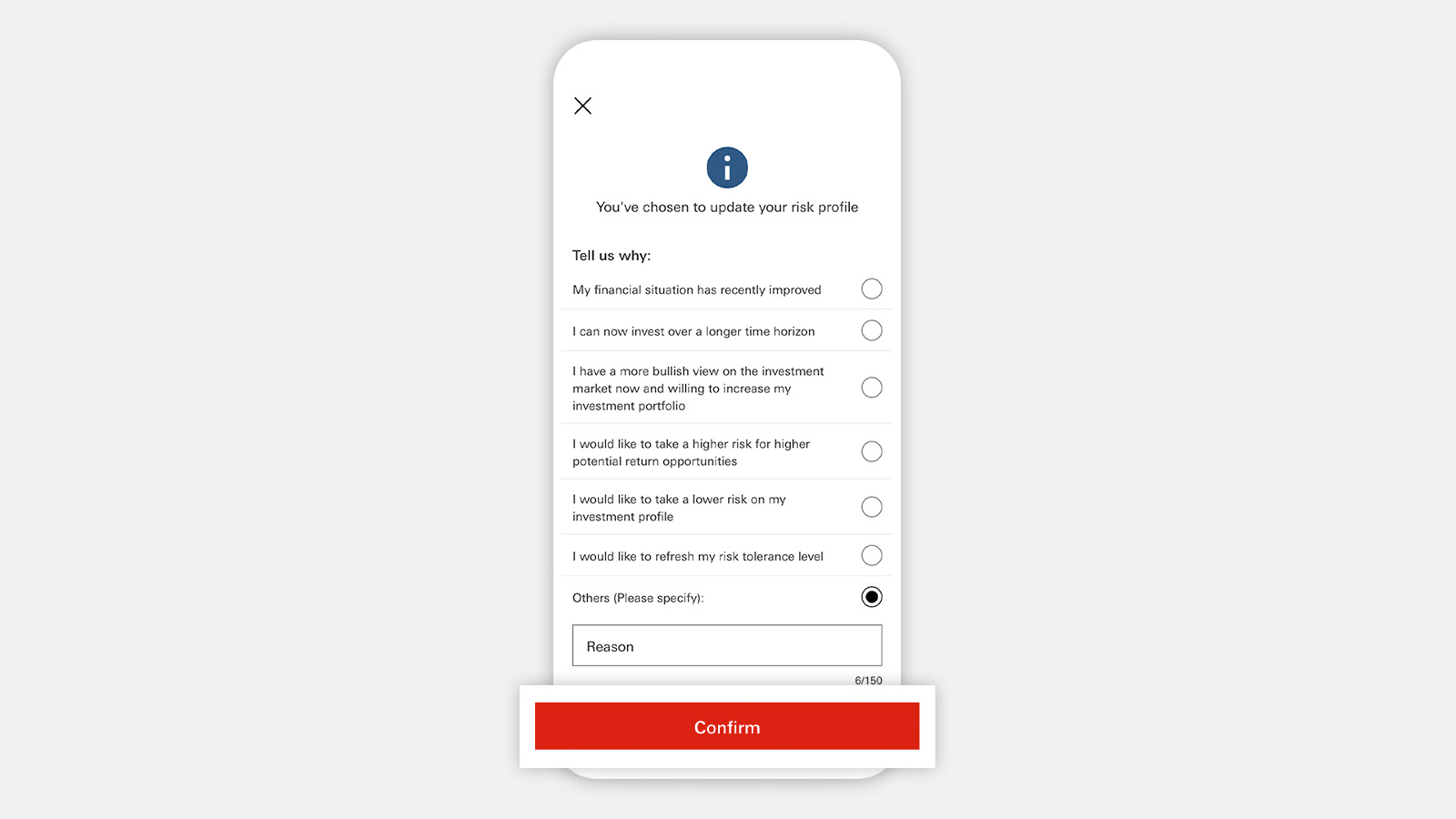

Step 4: Select a reason for your risk tolerance level assessment

What the different risk tolerance levels mean

Here is an explanation of the 6 possible risk profiles, numbered 0 to 5.

- Secure (0)

You generally don't want to take any investment risk, since you can accept no investment loss. - Very Cautious (1)

You are generally comfortable with achieving a minimal level of return on your investment coupled with minimal risks. - Cautious (2)

You are generally comfortable with achieving a low level of return on your investments coupled with a low level of risk. - Balanced (3)

You are generally comfortable with achieving a moderate level of return on your investment coupled with a moderate level of risk. - Adventurous (4)

You are generally comfortable with achieving a high level of return on your investment coupled with a high level of risk. - Speculative/Risky (5)

You are generally comfortable with maximising your potential return on investment coupled with a very high level of risk.

Ready to start?

Download the app

Scan the QR code to download the HSBC Malaysia app now.

Download the HSBC Malaysia app to take the questionnaire.

New to investing?

If you're new to investing with HSBC, you can open an investment account to get started.