Why is HSBC/HSBC Amanah charging customers a paper statement fee?

As a socially responsible organisation, HSBC/HSBC Amanah is committed towards reducing paper consumption. As a result of this commitment, we have invested in e-technologies that can provide password-protected soft copies of bank statements at absolutely no cost to our customers. By implementing the paper statement fee, we aim to encourage customers to switch to these secure, effective and convenient e-channels to receive their banking statements.

Which accounts/customers will be charged for receiving paper statements?

All retail banking customers who continue to receive paper statements will be charged a paper statement fee except for account holders of the following:

- Basic Savings Account/-i

- Basic Current Account/-i

- HSBC Premier Account/-i

Who is exempted from the paper statement fee?

Exemptions will be applied to the following groups:

- Customers aged 60 and above (automatic exemption)

- Customers with disabilities (exemption subject to customer's declaration)

- Customers facing difficulties accessing their banking statements online (exemption subject to customer's declaration)

I will be turning 60 next year in April. Will I be exempted from the paper statement fee from January next year or only from April?

Exemptions will be applied to customers turning 60 during their birthday month, so this means you won't be charged a paper statement from April onwards.

How can I avoid the paper statement fee?

You won't be charged any paper statement fee if you choose to receive eStatements. You'll be able to view, download and print up to 12 months' worth of banking statements through online banking, anytime, anywhere.

How do I enrol for eStatements?

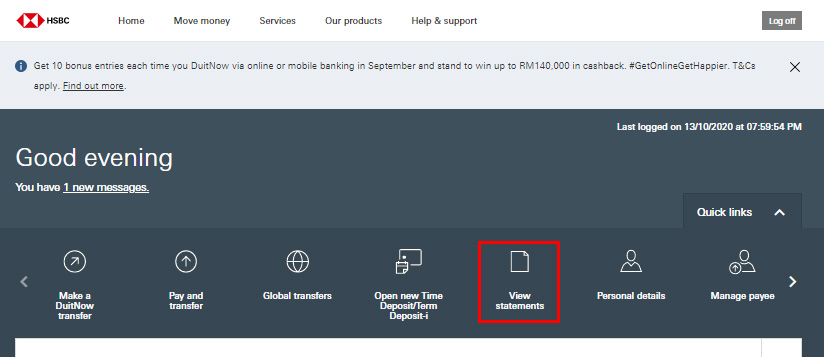

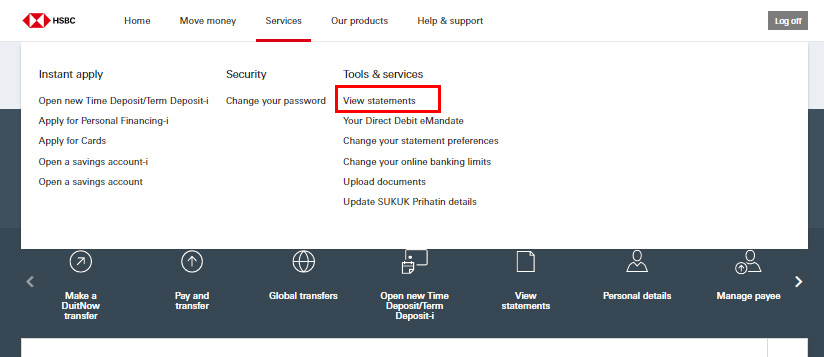

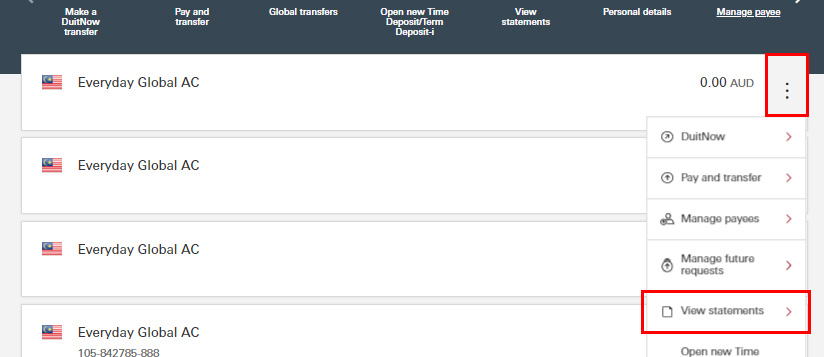

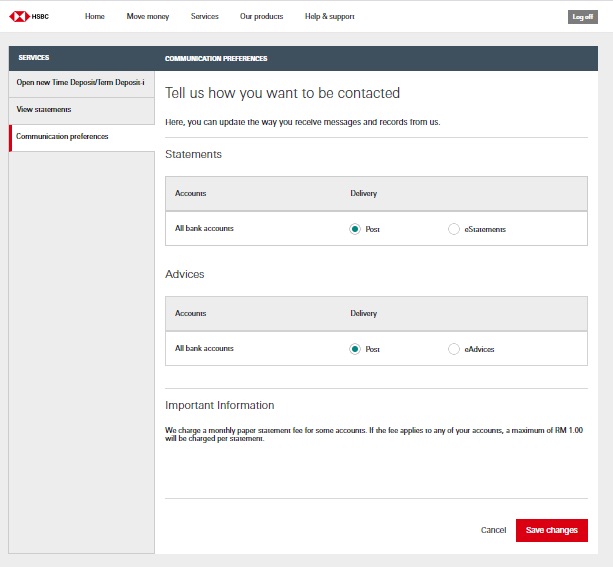

You can sign up to receive eStatements by logging on to online banking and then following these steps:

- Click on "Change your statement preferences"

- Select "eStatements and eAdvices" for all bank accounts

- Click on "Save changes"

After you've saved your changes, all banking statements for sole and joint accounts in your name with HSBC Bank Malaysia Berhad and HSBC Amanah Malaysia Berhad (except joint accounts where your joint accountholders do not have online banking and/or have not made any choice on how to receive their banking statements) will automatically be sent to you as eStatements.

I don't have access to HSBC/HSBC Amanah online banking. Is there an alternative to avoid being charged the paper statement fee?

Yes. You may sign up to receive your banking statements via email.

How do I sign up for email statements?

You may visit your nearest bank branch or call the HSBC Contact Centre at 1300-88-1388 to register your email address and request for email statements.

If I sign up for eStatements now, when will I start receiving them?

Your first eStatement will be made available to you on your account's next statement date. All subsequent eStatements will be stored online for a period of up to 12 months.

I have a sole account and 2 joint accounts - 1 with my wife and 1 with my child. If I have yet to sign up for eStatements and receive a total of 3 hard copy paper statements, what is the paper statement fee I will be charged?

The paper statement fee will be charged for each set of statements you receive. In this case, you will be charged a total of RM4.50 (RM1.50 for each set of hard copy banking statements).

I have a joint account with my husband who is eligible for the exemption. Will this account be charged if we continue to receive hard copy paper statements?

If either one of the joint accountholders is eligible for an exemption, the account will be considered exempted from the paper statement fee. However, if the non-exempted customer has a sole account and continues receiving hard copy paper statements, the paper statement fee will still be charged for this sole account.

Which account will the paper statement fee be debited from?

We will debit the fee from the account for which the hard copy banking statement is generated for.

When will the fee be debited if I continue to receive paper statements?

The fee will be debited on the date the paper statement is generated.

Will HSBC still debit my account if there are insufficient funds in it?

Yes, the paper statement fee will still be debited from your account. But we encourage you to switch to eStatements to enjoy fuss-free management of your banking statements online, at zero charge.

I have multiple accounts with HSBC/HSBC Amanah. Will I be charged paper statement fees for every account?

If you have opted to receive composite statements, you will only be charged once for each composite statement. However, if you have opted to receive individual statements for each of your accounts, you will be charged a paper statement fee for each hard copy account statement you receive.

Can I opt to receive composite statements instead of individual statements if I have multiple accounts? How do I do that?

Yes. You may opt to receive composite statements instead of individual statements if you have multiple accounts. Please visit your nearest bank branch to update your preference.

How often will I receive my email statements or eStatements?

Banking email statements/eStatements will be made available with the same frequency and date of your paper statements.

Can I change the frequency of how often I receive my banking statements? How do I do that?

Yes. You may change the frequency of how often you receive your banking statements. Please visit your nearest branch to update your preference.

What software is required to download and view email statements or eStatements on my computer/mobile phone?

You will require PDF readers like Adobe Acrobat Reader 4.0 or more updated versions of that.

Can I subscribe to both email statements and eStatements?

Yes, you may subscribe to both email statements and eStatements for your banking accounts. For credit cards, your email statements will be discontinued once you've subscribed to eStatements.