What is Interbank GIRO (IBG)?

IBG allows you to transfer funds from your savings or current account to an account at another bank, regardless of whether that account is a savings, current, loan/financing or credit card/-i account. This service is provided by PayNet.

How are individual customers able to perform IBG transfers?

Individual customers can perform IBG transfers through the following channels:

- HSBC Malaysia online banking

- HSBC Malaysia Mobile Banking App

- ATM

- Branch

Which financial institutions offer IBG?

There are 43 banks that offer IBG, allowing their customers to receive and send funds via IBG.

Refer to this list for participating banks.

What are the daily limits to the amount of money that can be transferred via IBG?

- HSBC Malaysia online banking - RM50,000. You may reduce or increase your daily transfer limit, up to a maximum of RM50,000 under "Services" → "Change internet banking limits"

- ATM - RM5,000

- Branch - RM1,000,000

What are the service charges for using IBG?

- HSBC Malaysia online banking - RM0.10

- HSBC Malaysia Mobile Banking App - RM0.10

- ATM - RM0.10

- Branch - RM0.30

You may also refer to "HSBC/HSBC Amanah Tariff and Charges" on our website for the current fees and charges for using IBG.

How long will it take to transfer funds to other banks via IBG?

| Crediting time | *Funds received by beneficiaries | *Refund for unsuccessful transactions |

|---|---|---|

Business days (Monday to Friday) Before 5:00am |

Same business day By 11:00am |

By 5:00pm |

Business days (Monday to Friday) 5:01am - 8:00am |

Same business day By 2:00pm |

By 8:20pm |

Business days (Monday to Friday) 8:01am - 11.00am |

Same business day By 5:00pm |

By 11:00pm |

Business days (Monday to Friday) 11:01am - 2:00pm |

Same business day By 8:20pm |

By 11:00am (next business day) |

Business days (Monday to Friday) 2:01pm - 5:00pm |

Same business day By 11:00pm |

By 11:00am (next business day) |

Business days (Monday to Friday) After 5:00pm |

Next business day By 11:00am |

By 5:00pm |

| Non-business days (Saturday, Sunday and Federal Territory public holidays) | Next business day By 11:00am |

By 5:00pm |

| Crediting time |

Business days (Monday to Friday) Before 5:00am |

|---|---|

| *Funds received by beneficiaries |

Same business day By 11:00am |

| *Refund for unsuccessful transactions | By 5:00pm |

| Crediting time |

Business days (Monday to Friday) 5:01am - 8:00am |

| *Funds received by beneficiaries |

Same business day By 2:00pm |

| *Refund for unsuccessful transactions | By 8:20pm |

| Crediting time |

Business days (Monday to Friday) 8:01am - 11.00am |

| *Funds received by beneficiaries |

Same business day By 5:00pm |

| *Refund for unsuccessful transactions | By 11:00pm |

| Crediting time |

Business days (Monday to Friday) 11:01am - 2:00pm |

| *Funds received by beneficiaries |

Same business day By 8:20pm |

| *Refund for unsuccessful transactions | By 11:00am (next business day) |

| Crediting time |

Business days (Monday to Friday) 2:01pm - 5:00pm |

| *Funds received by beneficiaries |

Same business day By 11:00pm |

| *Refund for unsuccessful transactions | By 11:00am (next business day) |

| Crediting time |

Business days (Monday to Friday) After 5:00pm |

| *Funds received by beneficiaries |

Next business day By 11:00am |

| *Refund for unsuccessful transactions | By 5:00pm |

| Crediting time | Non-business days (Saturday, Sunday and Federal Territory public holidays) |

| *Funds received by beneficiaries |

Next business day By 11:00am |

| *Refund for unsuccessful transactions | By 5:00pm |

*Under normal circumstances

How will I know if my fund transfer has been successful or not?

A successful transfer will be reflected in your month-end banking statement. If the fund transfer is unsuccessful, you'll receive an SMS from us to notify you about the rejected transaction, as long as you have registered your current mobile phone number with us.

What happens if I transferred funds to a wrong account number?

The funds will be transferred and the amount debited from your account. You're advised to carefully check the beneficiary’s account number to ensure you're transferring funds to the correct beneficiary.

What is a recurring transfer and how can I make one?

What is a recurring transfer and how can I make one?Recurring transfers allow a transaction to be repeated in regular intervals so that a manual transaction is not necessary each time (e.g. for a fixed bill payment you have to make each month).

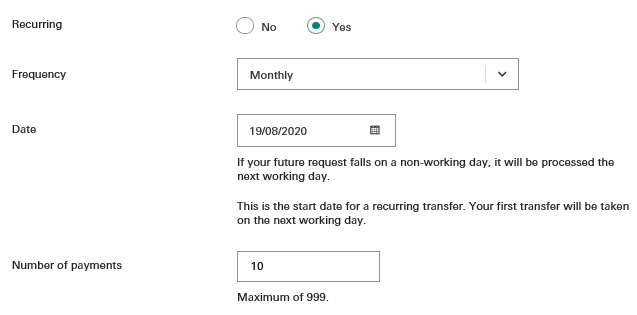

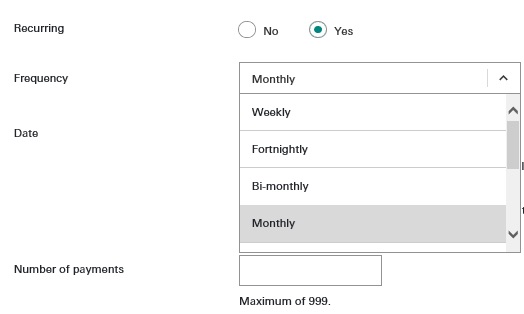

Recurring transfers can be done by selecting the "Yes" option shown below. You will then be able to select the frequency for which you'd like the transfers to be made.

What is a future dated transaction and how can I make one?

Future dated transactions allow you to choose a future date for a transaction to occur.

You can set one up by selecting the "Yes" option shown below.