7 great ways to use extra cash

Flush with cash? Don't flush it away! Whether it's a bursary, tax refund or annual bonus, here are 7 great ways to enjoy your windfall – and 3 ways to waste it.

1) Pay off your credit cards

Sure it's not the most glamorous way to spend your money, but it guarantees you'll have money in the future. Credit card debt, with its high levels of interest, is extremely hard to get rid of if you're only paying the minimum.

You don't have to wait for a windfall to pay off your credit cards. Consider a Balance Transfer Instalment from HSBC.

2) Invest it

If you don't know much about investing, go basic with something like a bond or an ETF. They are lower risk than many other investments, but you will still be slowly building a nest egg that will be there for you in the future. If you're not sure where to start, we can help.

3) Learn a new skill

Go back to school for another degree. Learn a new language. Get licensed in something. All of these things will open up your career prospects, giving you a higher potential salary in the future. Alternatively you can learn a skill like cooking, plumbing, carpentry or auto mechanics. Even if they're not where you see your career moving, having a little bit of know-how in these fields will go a long way to saving you money.

Find out more about the value of education.

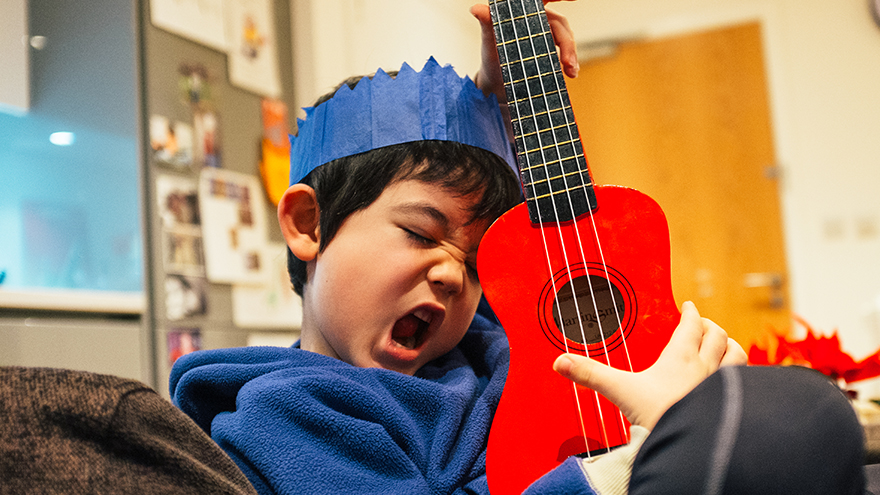

4) Get creative

Now's your chance to channel your inner artist. Learn to sing, to dance, to paint, to play an instrument. These skills might not unlock your earning potential (although you never know) but they could open up a whole new way for you to experience and understand the world. Having a way to express yourself creatively is great for your mental health, not to mention a lot of fun.

5) Travel

Hit the road for an epic adventure. Travel is a great way to experience other cultures and learn about ourselves at the same time. It can create lifelong memories but it can also be quite expensive. Having a lump sum that you can use toward a travel budget can help you take that trip you've always dreamed of.

Planning to hit the road? Consider the HSBC Premier Travel Credit Card. It gives you free access to Plaza Premium Lounges worldwide and unlimited Wi-Fi through Boingo.

6) Fix up your home

Travel is great, but so is having a nice place to call home. If you own, consider making some renovations and upgrading your kitchen or bathroom. If you rent, think about replacing any furniture that is past its prime. Even something as simple as changing the curtains or putting on a fresh coat of paint can go a long way to refreshing your living space, making it a joy to come home to each day.

Got a huge project you've been waiting to complete? A personal loan from HSBC could help you cover the cost.

7) Get fit

Consider this an overall investment in your livelihood, as physical health is something that will affect every element of your life. Things like gyms, yoga memberships, personal trainers, and meal plans or dietary consultations can be expensive, but you'll often be able to save some money if you're able to pay for these memberships or services up front. The best part is, six months down the road you'll be healthier than you are today and you'll still have a place to get your sweat on.

What not to spend it on:

1) Fashion

As the name implies, fashion is not forever. Outside of a few choice outfits for work, any money you spend on clothes or jewelry is not an investment; these are things that have very temporary value. A new bag or the latest kicks might make you happy for the moment, but the benefit they provide doesn't last long.

2) Getting a pet

This is not to say you shouldn't get a pet. Maybe you've always wanted a furry (or feathery or scaly) friend in your life. But if you're waiting for a windfall to make that happen, that's a mistake.

Pets are not a one-time purchase, they continue to cost you money day after day, month after month for years. If the only way you can afford a dog is because you got a big tax refund, how will you afford it when the dog gets sick and needs a vet? Or when you need to put your pet in a kennel because you are going away?

3) Nothing at all

It can be difficult deciding what to use your windfall for, but as it sits in your bank account there is a real danger of "nickel & diming" it away: spending it a tiny bit at a time on things that don't add up to much. You don't want to look back on this moment as a wasted opportunity, so do a little research and a little planning and make your money count for you.

Reach out to the world with HSBC Foreign Exchange

Information provided above is for reference only.

This document is issued by HSBC Bank Malaysia Berhad (Company No. 127776-V) ("we", "us" or "our"). The contents of this document are confidential and are intended for use by the customer whom this document is prepared for and addressed to the customer ("you" or "your") exclusively and may not be divulged without our prior and express consent. This document is provided to you solely for the purposes of enabling you and us to review how we and other members of the HSBC Group (collectively "HSBC") currently provide products and services to you and to discuss how HSBC can enhance and improve on the same. Any other use is prohibited unless you first request and obtain our written permission.

While reasonable care has been taken to ensure the accuracy of this document, HSBC does not make any representation or warranty (expressed or implied) of any nature including, without limitation, the adequacy, accuracy, currency, correctness or completeness of the information contained herein (whether the information is generated from or held within the HSBC system or is provided by third parties) and HSBC does not accept responsibility or liability for any errors or omissions. Any opinions in this document constitute the present view or judgment of HSBC and is subject to change without notice. This document is intended for reference and to facilitate discussion only and should not be relied upon by you for any purposes and shall not be capable of creating any contractual commitment on the part of HSBC. Any examples given are for purposes of illustration only.

To the extent permitted by law, HSBC shall not be liable for any damage, loss or liability (whether arising in contract, tort, including negligence, or otherwise) arising out of or in connection with your use of or reliance upon this document. The aforesaid exclusions apply to any damage which is direct, indirect, special, incidental or consequential or consists of loss of profits, business, goodwill, opportunity or data. All of the above exclusions apply even if you have advised HSBC of the possibility of the above types of damage, loss or liability.

All intellectual property rights (including, without limitation, copyright, database rights, design rights, patents and trademarks) in this document are owned by or licensed to HSBC unless otherwise stated. Without limiting the above, unless you first obtain written consent from HSBC, you may not copy, reproduce, duplicate, publish, modify, adapt, publish, broadcast, create derivative works of or in any way exploit all or any part of this document.