Table of contents

- 24/7 Foreign currency conversion

- Global Money Transfers (Global payments via the HSBC Mobile Banking App)

- Outward Telegraphic transfers

- Inward Telegraphic transfers

- HSBC SWIFT Code

- Global View and Global Transfer

- Global Transfers for family and friends (to third party HSBC accounts)

- FX Rate Alerts

- Bank Negara Malaysia Foreign Exchange Policy

24/7 Foreign currency conversion

When will the funds be available in the crediting account?

Fund transfers are executed real-time, so the funds will be credited immediately.

Global Money Transfers

What is 'Global Money Transfers (GMT)'?

With HSBC Global Money Transfers, you can transfer money worldwide faster and zero-fee1, in just a few taps on the HSBC Malaysia Mobile Banking app (HSBC Malaysia app).

Global Money Transfers is only available on the HSBC Malaysia app. It offers a fast and cost-effective solution compared to traditional international transfer methods such as SWIFT. Unlike SWIFT, Global Money Transfers uses an internal messaging system which reduces transfer costs and time, making it more efficient to send money internationally.

Important note: To avoid payment rejection, please check with the beneficiary bank if a clearing agent is required. If it is, please visit an HSBC branch to make the transaction, instead of using Global Money Transfers.

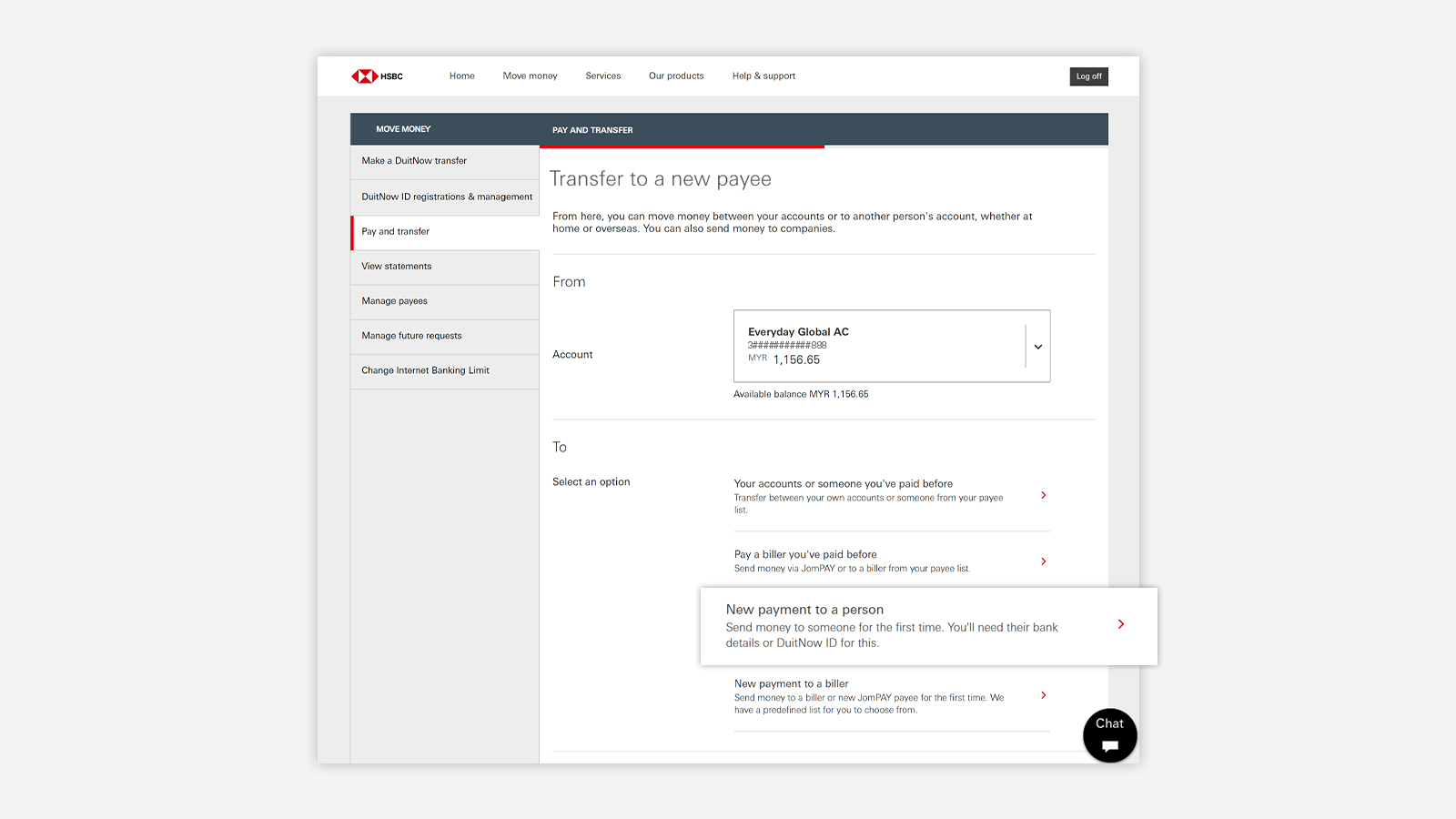

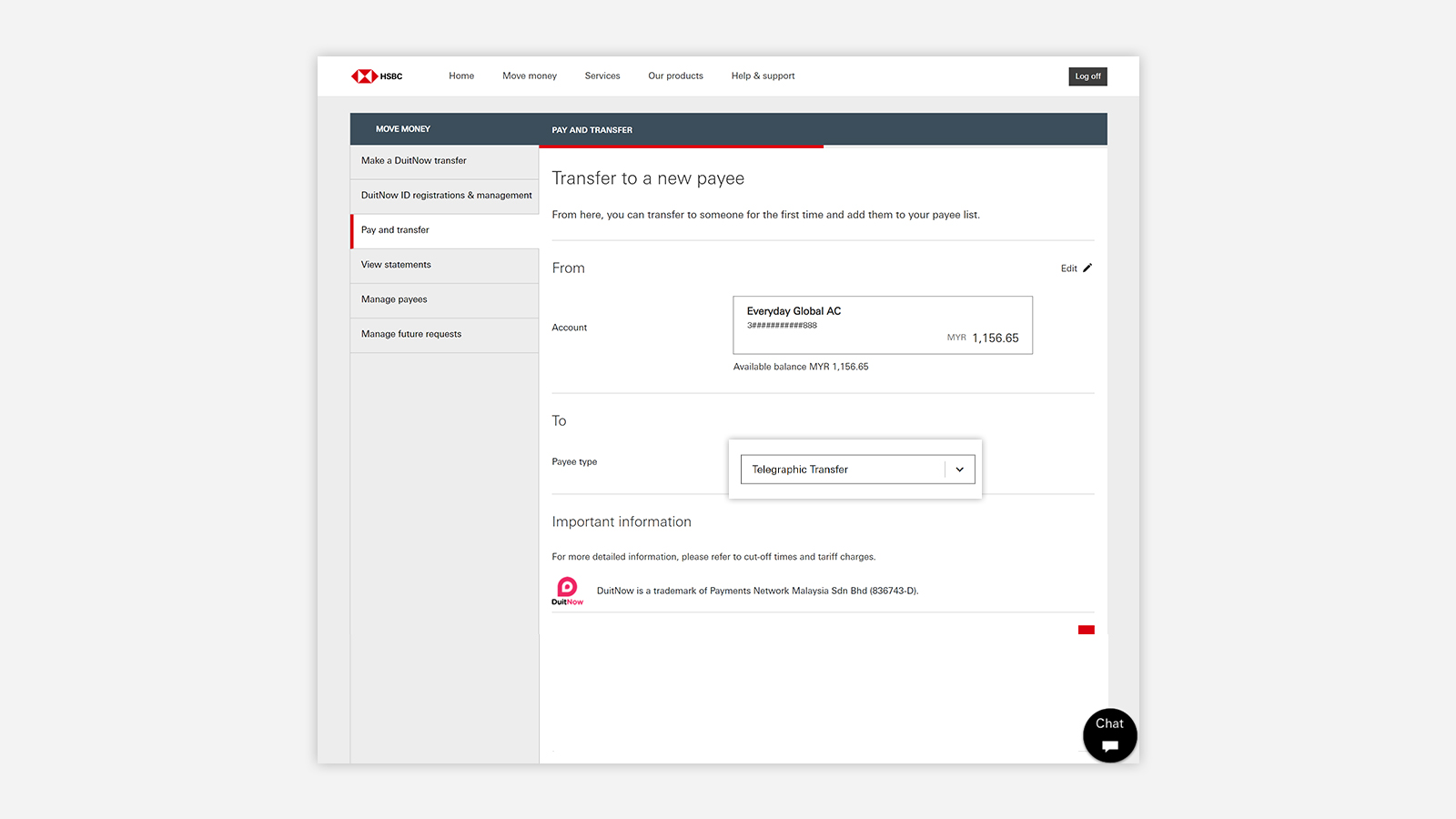

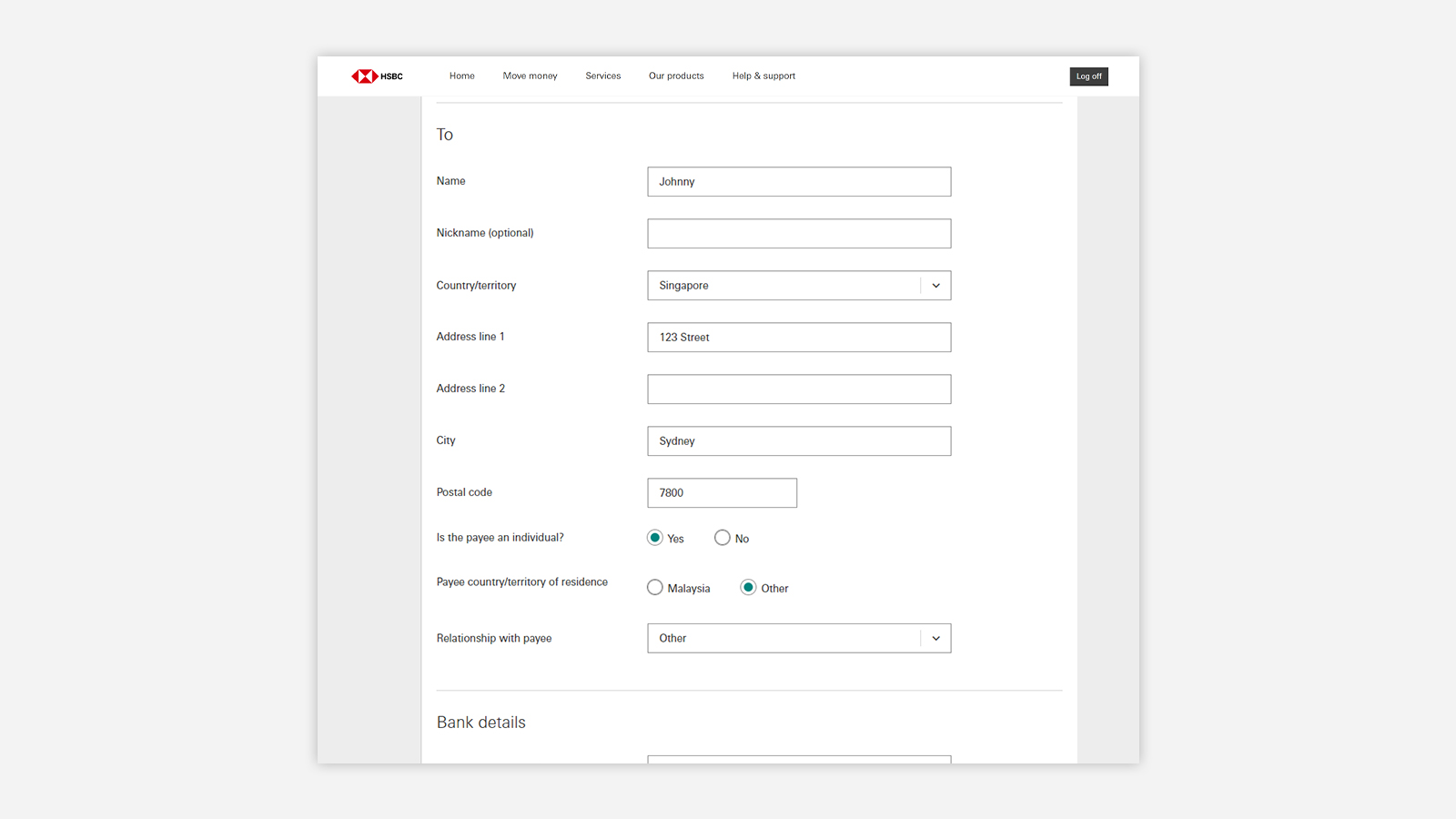

Outward Telegraphic Transfers

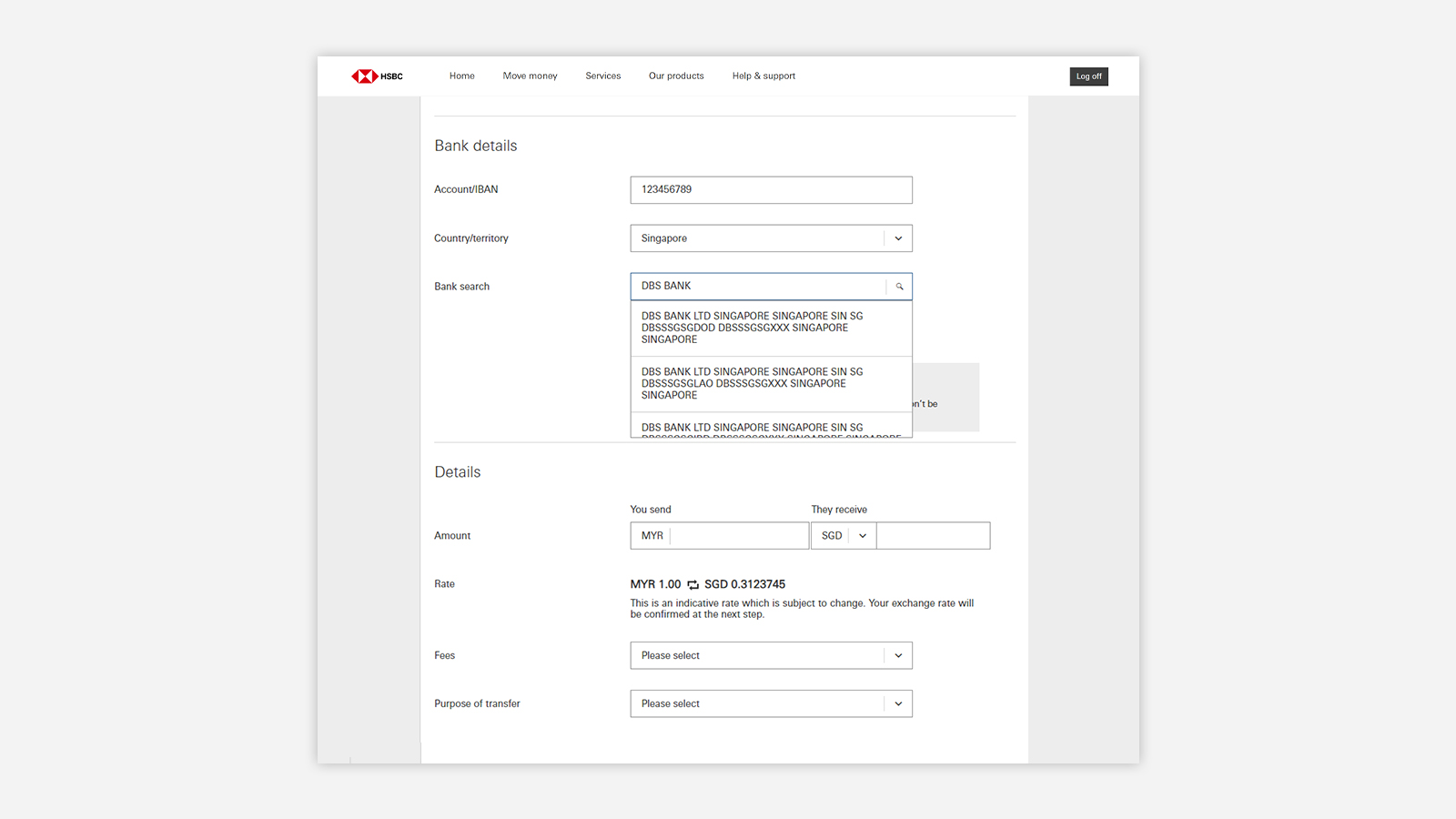

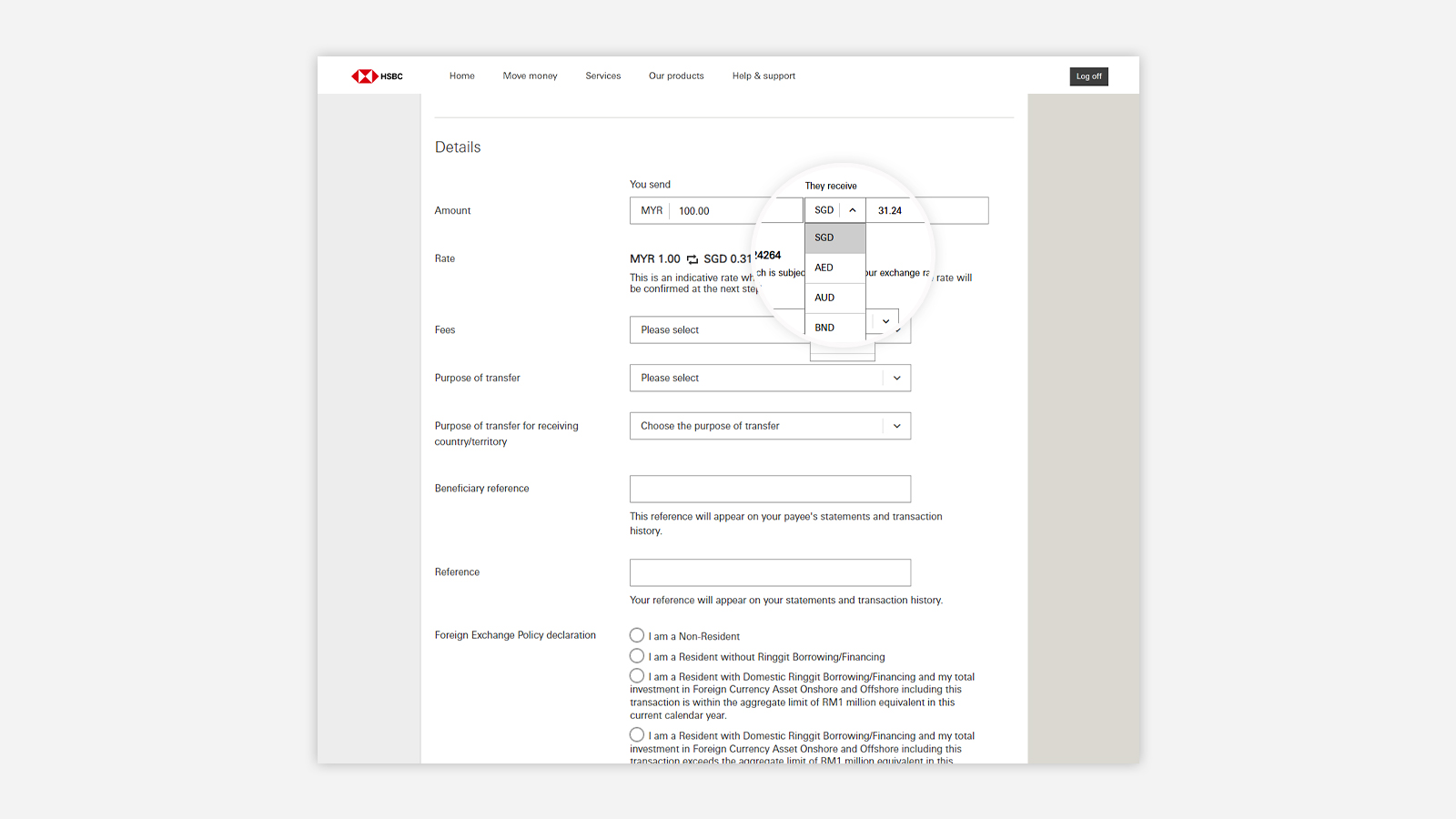

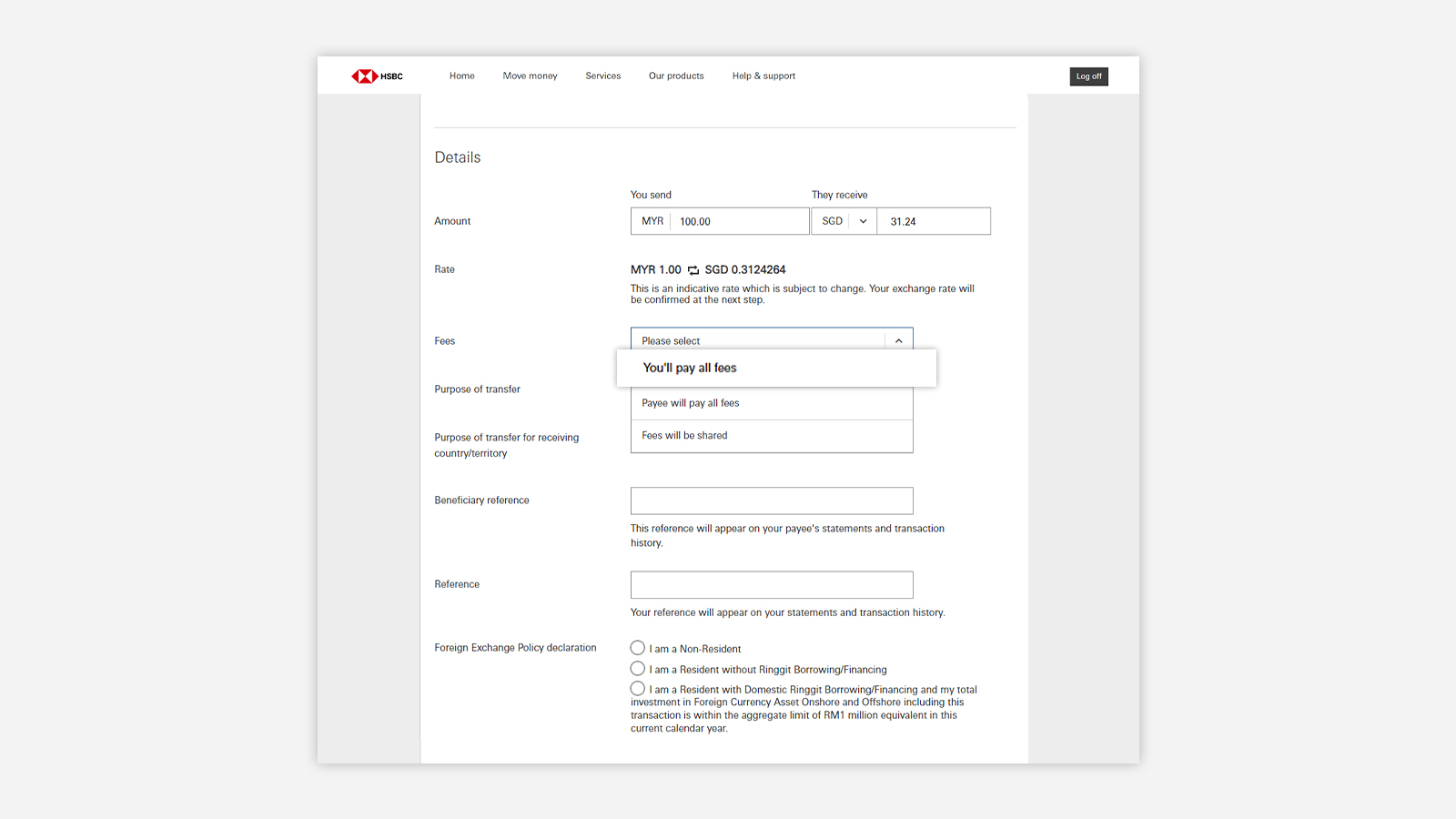

What information is required to transfer funds to an overseas beneficiary?

You'll need the following information:

a) Recipient's account number/IBAN details

b) Recipient's name

c) SWIFT/BIC code

Important note: To avoid payment rejection, please check with the beneficiary bank if a clearing agent is required. If it is, please visit an HSBC branch to make the transaction, instead of using Telegraphic Transfers.

Inward Telegraphic Transfers

What information should I provide to my remittance counterpart?

You should provide:

- Beneficiary bank Name

- Beneficiary account number

- SWIFT code

- Purpose of payment

- SWIFT code

- Beneficiary account number

Note: Inward TT without purpose of payment will be rejected or if the purpose of payment is unclear, there might be delay in your inward TT. The fees of rejected inward TT is not refundable.

| Currency | Banks | SWIFT/BIC |

|---|---|---|

| AED | HSBC Bank Middle East, Dubai, United Arab Emirates | BBMEAEAD |

AUD |

HSBC Bank Australia Limited, Sydney |

HKBAAU2SSYD |

BND |

Malayan Banking Berhad |

MBBEBNBB |

CAD |

Royal Bank of Canada |

SWIFT/BIC: ROYCCAT2 Clearing Code: 000300762 |

CHF |

UBS AG, Zurich |

UBSWCHZH80A |

| CNY | The Hongkong and Shanghai Banking Corporation Limited, Hong Kong SAR |

HSBCHKHHHKH |

| DKK | Danske Bank A/S, Copenhagen, Denmark | DABADKKK |

EUR |

HSBC Continental Europe |

CCFRFRPP |

GBP |

HSBC Bank Plc, London |

MIDLGB22 |

HKD |

The Hongkong and Shanghai Banking Corporation Limited, Hong Kong SAR |

HSBCHKHHHKH |

| IDR | PT Bank HSBC Indonesia | HSBCIDJA |

| INR | The Hongkong and Shanghai Banking Corporation Limited Mumbai, India | HSBCINBB |

JPY |

The Hongkong and Shanghai Banking Corporation Limited, Tokyo |

HSBCJPJT |

| LKR | The Hongkong and Shanghai Banking Corporation Limited Colombo, Sri Lanka | HSBCLKLX |

| NOK | DNB Bank ASA, Oslo | DNBANOKK |

NZD |

The Hongkong and Shanghai Banking Corporation Limited, Auckland |

HSBCNZ2A |

| PHP | The Hongkong and Shanghai Banking Corporation Limited, Philippine | HSBCPHMM |

SAR |

Saudi Awwal Bank |

SABBSARI |

| SEK | Skandinaviska Enskilda Banken AB, Sweden | ESSESESS |

SGD |

HSBC Bank (Singapore) Limited |

HSBCSGSG |

| THB | The Hongkong and Shanghai Banking Corporation Limited, Bangkok | HSBCTHBK |

USD |

HSBC Bank USA, New York |

MRMDUS33 |

ZAR |

HSBC Bank Plc |

HSBCZAJJ |

| Currency | AED |

|---|---|

| Banks | HSBC Bank Middle East, Dubai, United Arab Emirates |

| SWIFT/BIC | BBMEAEAD |

| Currency |

AUD |

| Banks |

HSBC Bank Australia Limited, Sydney |

| SWIFT/BIC |

HKBAAU2SSYD |

| Currency |

BND |

| Banks |

Malayan Banking Berhad |

| SWIFT/BIC |

MBBEBNBB |

| Currency |

CAD |

| Banks |

Royal Bank of Canada |

| SWIFT/BIC |

SWIFT/BIC: ROYCCAT2 Clearing Code: 000300762 |

| Currency |

CHF |

| Banks |

UBS AG, Zurich |

| SWIFT/BIC |

UBSWCHZH80A |

| Currency | CNY |

| Banks |

The Hongkong and Shanghai Banking Corporation Limited, Hong Kong SAR |

| SWIFT/BIC |

HSBCHKHHHKH |

| Currency | DKK |

| Banks | Danske Bank A/S, Copenhagen, Denmark |

| SWIFT/BIC | DABADKKK |

| Currency |

EUR |

| Banks |

HSBC Continental Europe |

| SWIFT/BIC |

CCFRFRPP |

| Currency |

GBP |

| Banks |

HSBC Bank Plc, London |

| SWIFT/BIC |

MIDLGB22 |

| Currency |

HKD |

| Banks |

The Hongkong and Shanghai Banking Corporation Limited, Hong Kong SAR |

| SWIFT/BIC |

HSBCHKHHHKH |

| Currency | IDR |

| Banks | PT Bank HSBC Indonesia |

| SWIFT/BIC | HSBCIDJA |

| Currency | INR |

| Banks | The Hongkong and Shanghai Banking Corporation Limited Mumbai, India |

| SWIFT/BIC | HSBCINBB |

| Currency |

JPY |

| Banks |

The Hongkong and Shanghai Banking Corporation Limited, Tokyo |

| SWIFT/BIC |

HSBCJPJT |

| Currency | LKR |

| Banks | The Hongkong and Shanghai Banking Corporation Limited Colombo, Sri Lanka |

| SWIFT/BIC | HSBCLKLX |

| Currency | NOK |

| Banks | DNB Bank ASA, Oslo |

| SWIFT/BIC | DNBANOKK |

| Currency |

NZD |

| Banks |

The Hongkong and Shanghai Banking Corporation Limited, Auckland |

| SWIFT/BIC |

HSBCNZ2A |

| Currency | PHP |

| Banks | The Hongkong and Shanghai Banking Corporation Limited, Philippine |

| SWIFT/BIC | HSBCPHMM |

| Currency |

SAR |

| Banks |

Saudi Awwal Bank |

| SWIFT/BIC |

SABBSARI |

| Currency | SEK |

| Banks | Skandinaviska Enskilda Banken AB, Sweden |

| SWIFT/BIC | ESSESESS |

| Currency |

SGD |

| Banks |

HSBC Bank (Singapore) Limited |

| SWIFT/BIC | HSBCSGSG |

| Currency | THB |

| Banks | The Hongkong and Shanghai Banking Corporation Limited, Bangkok |

| SWIFT/BIC | HSBCTHBK |

| Currency |

USD |

| Banks |

HSBC Bank USA, New York |

| SWIFT/BIC |

MRMDUS33 |

| Currency |

ZAR |

| Banks |

HSBC Bank Plc |

| SWIFT/BIC |

HSBCZAJJ |

HSBC SWIFT Code

What is the HSBC SWIFT Code and when is it needed?

| Banks |

SWIFT Code |

Address |

|---|---|---|

| HSBC Bank Malaysia Berhad |

HBMBMYKL |

Level 21, Menara IQ, Lingkaran TRX, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia. |

| HSBC Amanah Malaysia Berhad |

HMABMYKL |

Level 21, Menara IQ, Lingkaran TRX, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia. |

| Banks |

HSBC Bank Malaysia Berhad |

|---|---|

| SWIFT Code |

HBMBMYKL |

| Address |

Level 21, Menara IQ, Lingkaran TRX, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia. |

| Banks |

HSBC Amanah Malaysia Berhad |

| SWIFT Code |

HMABMYKL |

| Address |

Level 21, Menara IQ, Lingkaran TRX, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia. |

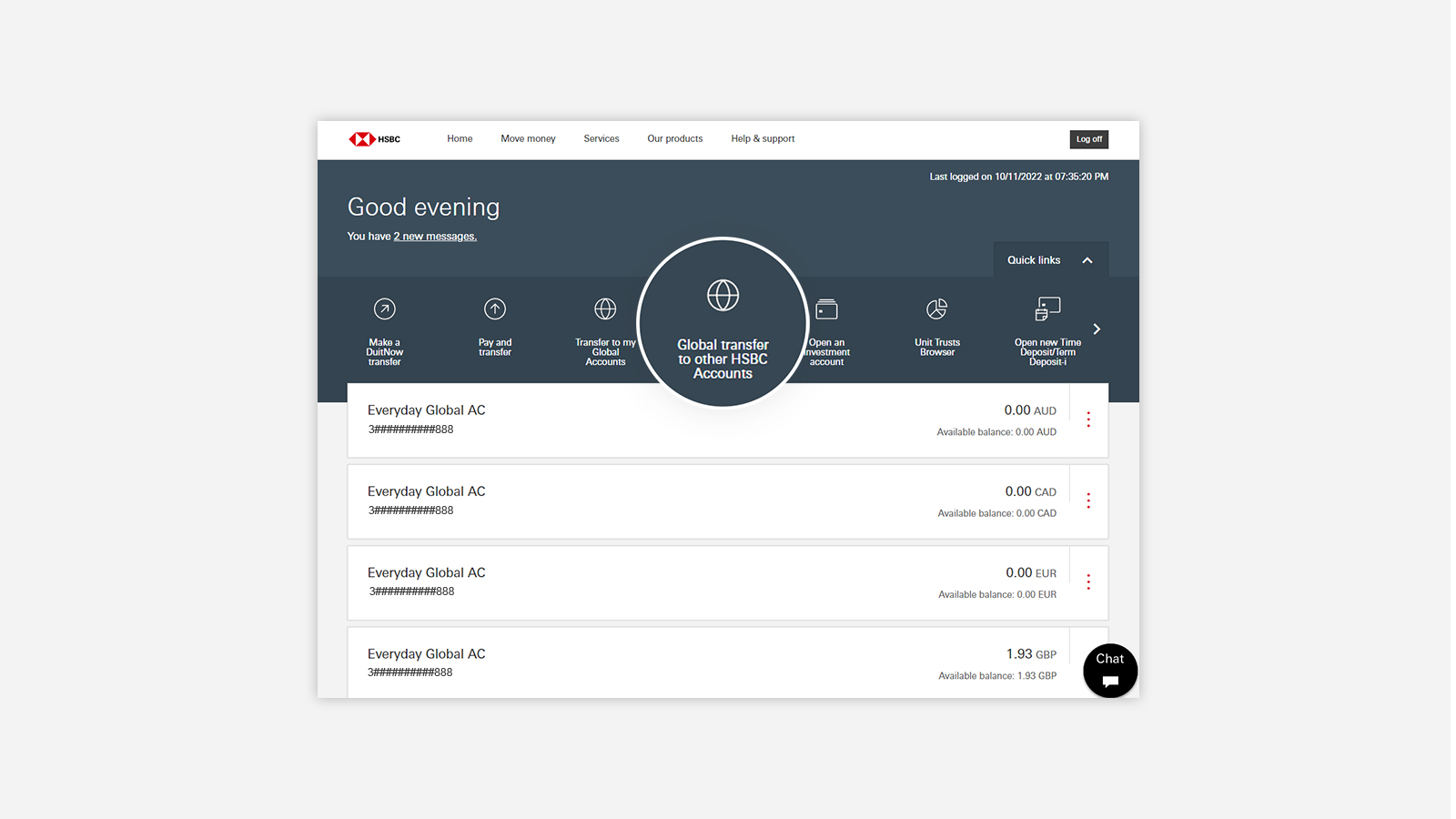

Global View and Global Transfers

What is "Global View (GV) and Global Transfers (GT)”?

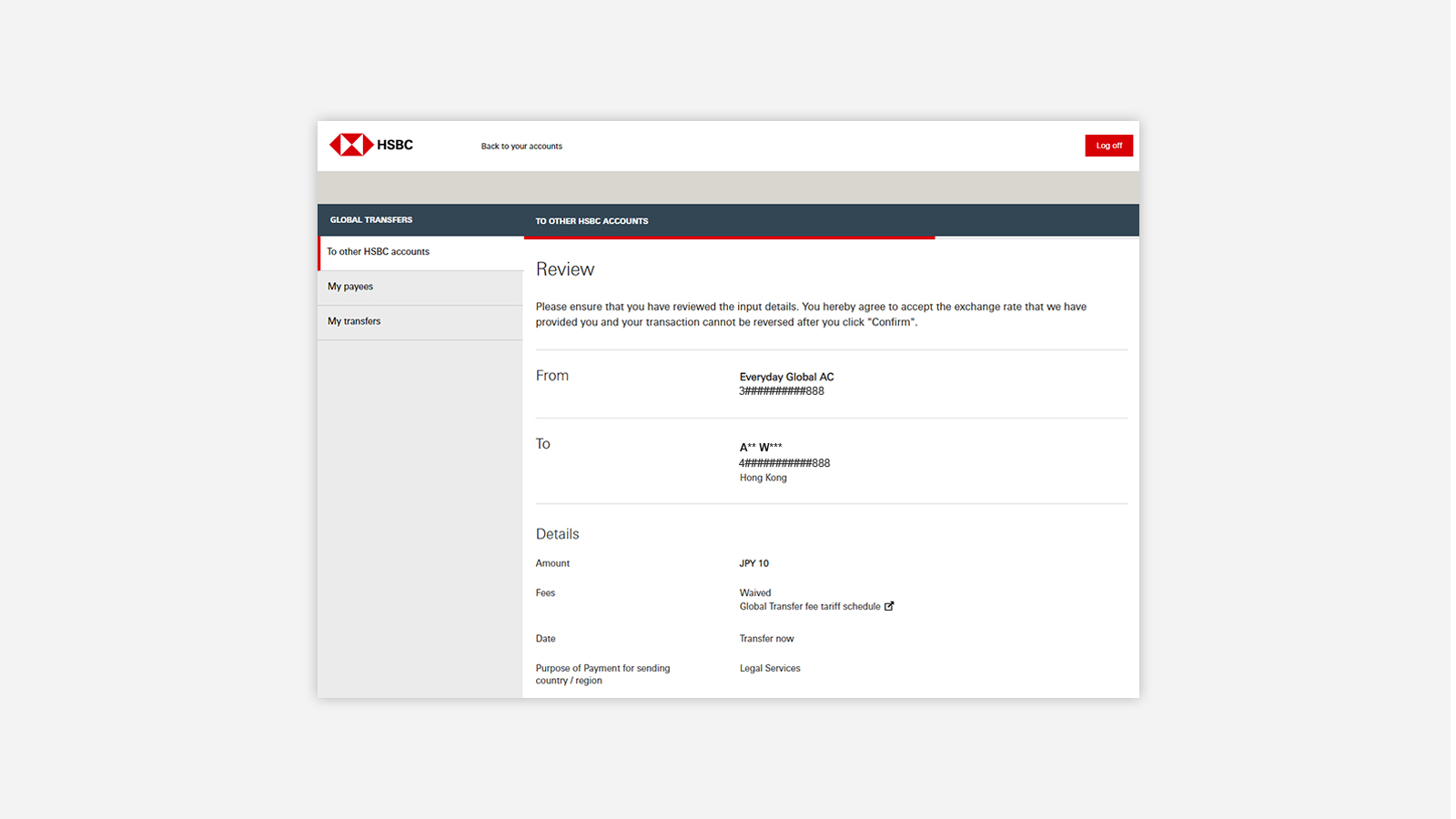

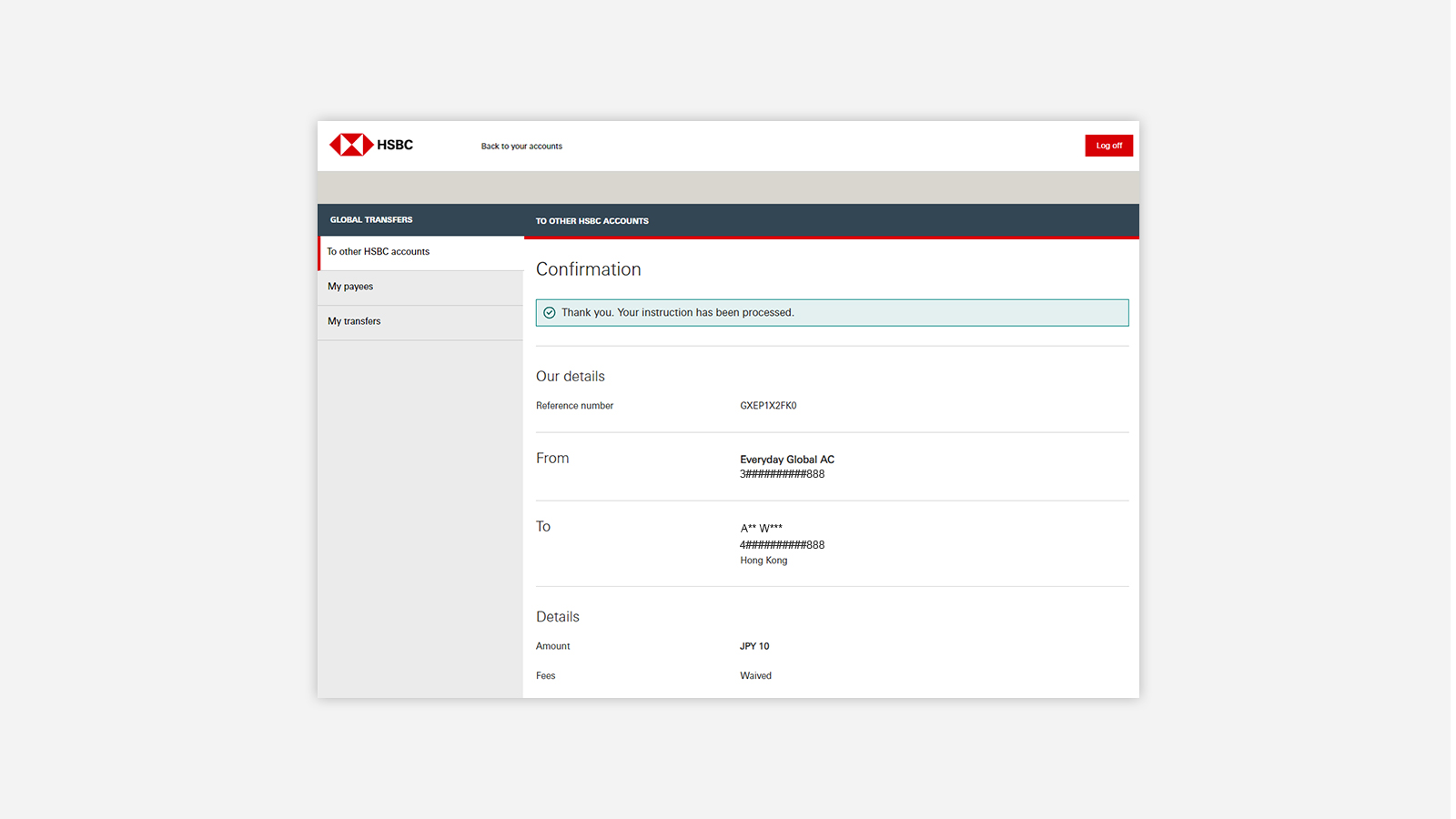

Global View is a unique service allowing HSBC Malaysia Premier and Advance customers to see all their worldwide HSBC accounts on one page. Once the accounts are linked together online, customer will be able to make secure Global Transfers to their own overseas HSBC account instantly with zero fee. The service can be accessed in HSBC Online Banking. You may watch the online demo of the service here.

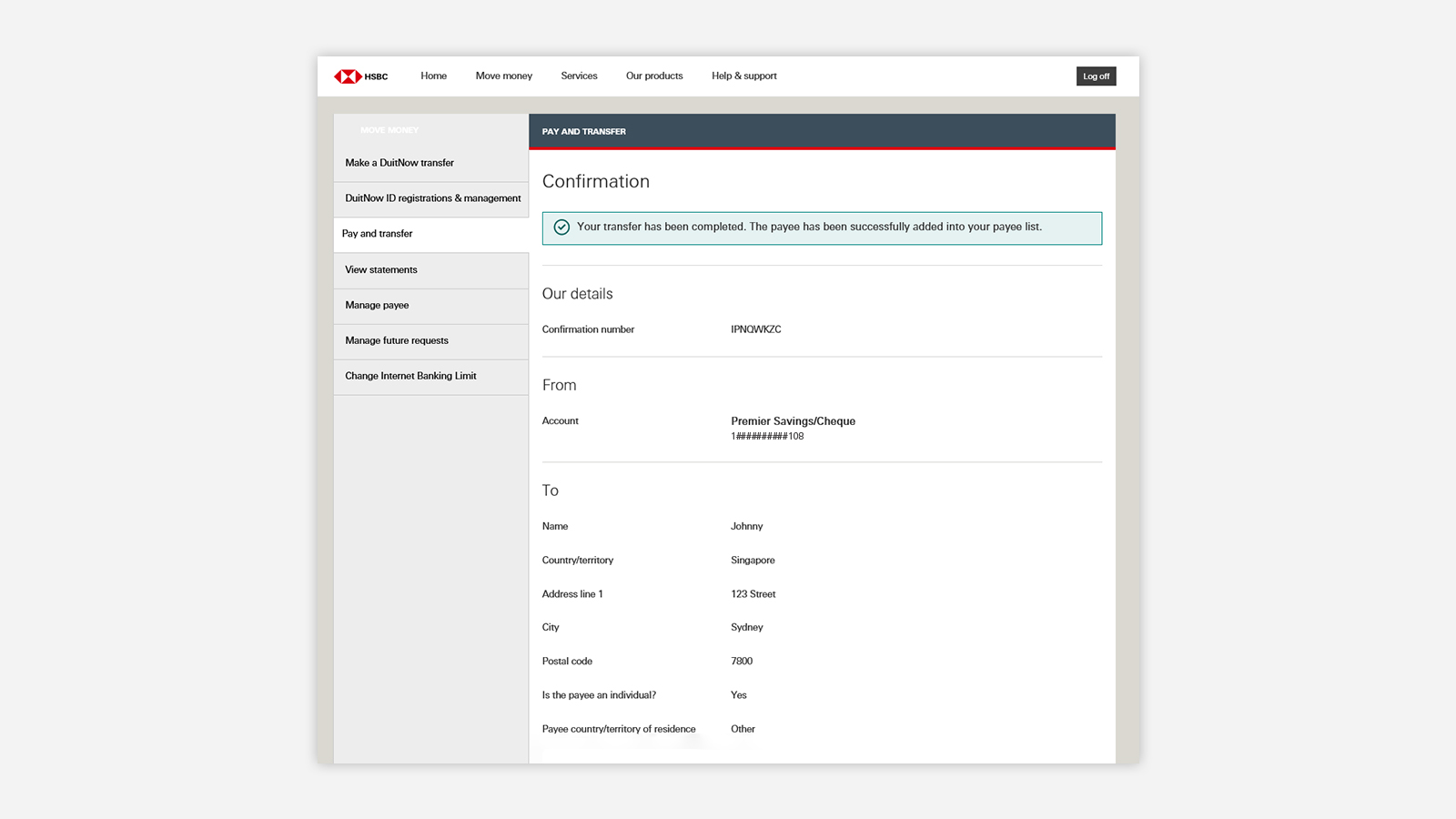

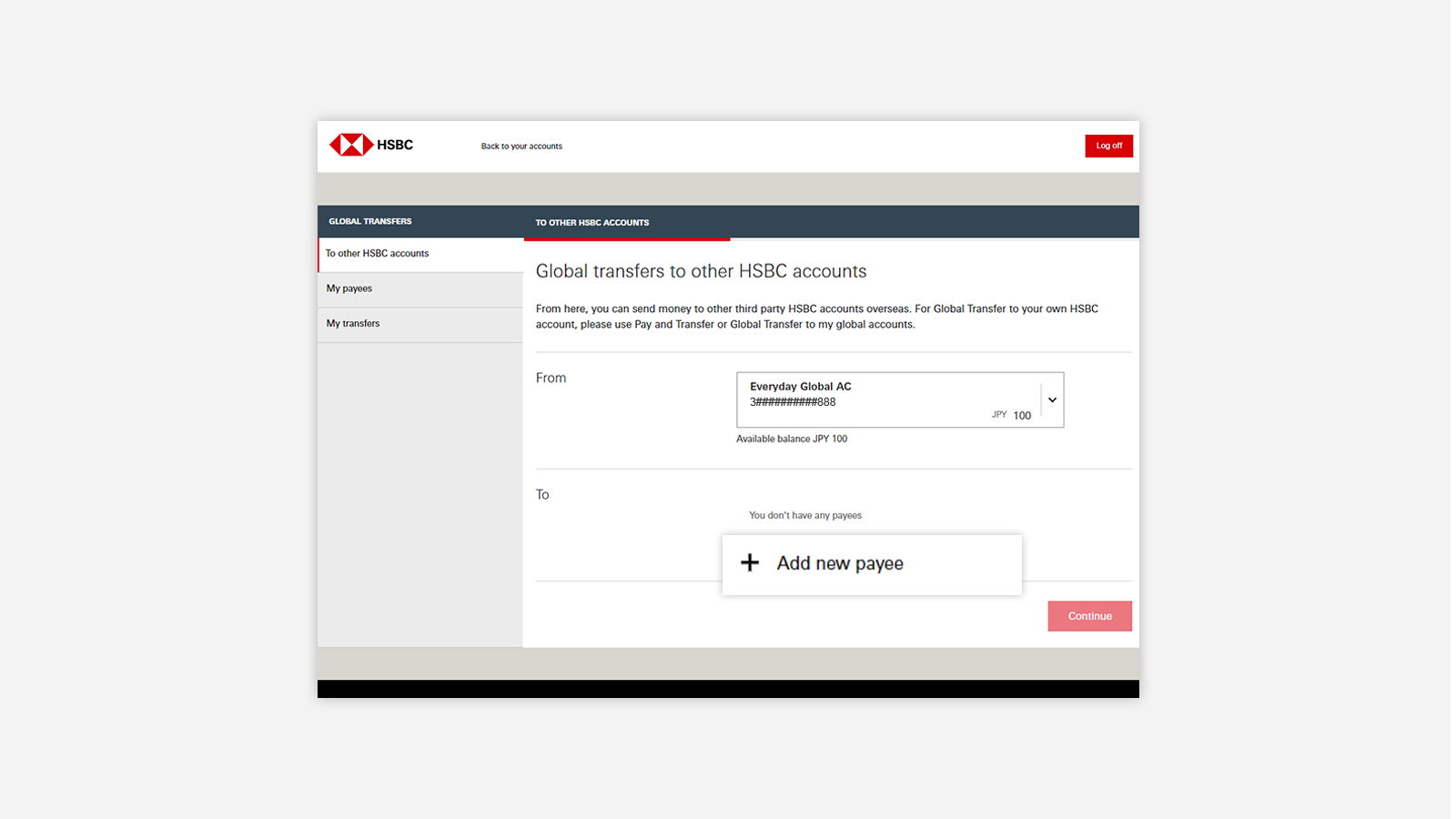

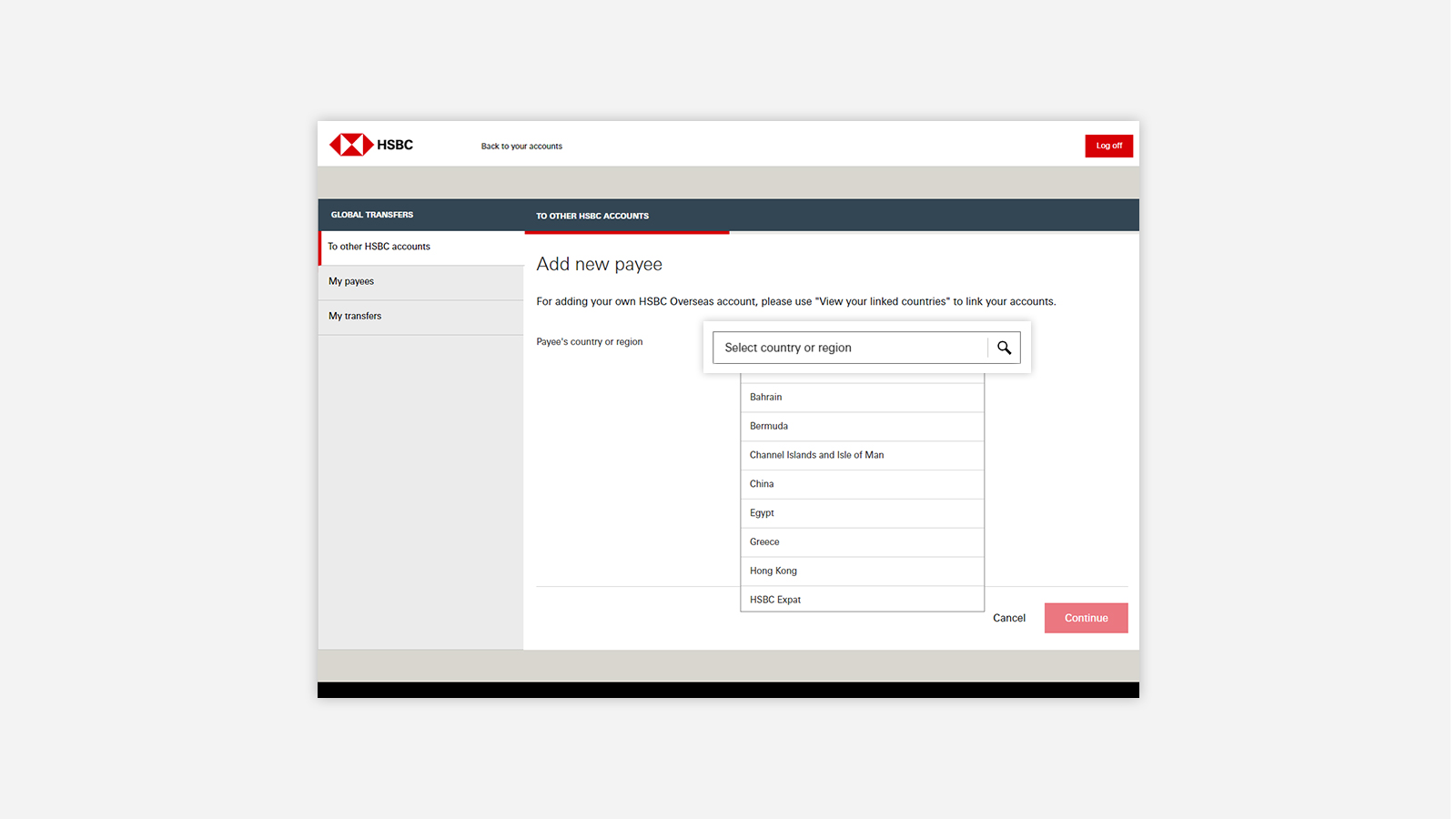

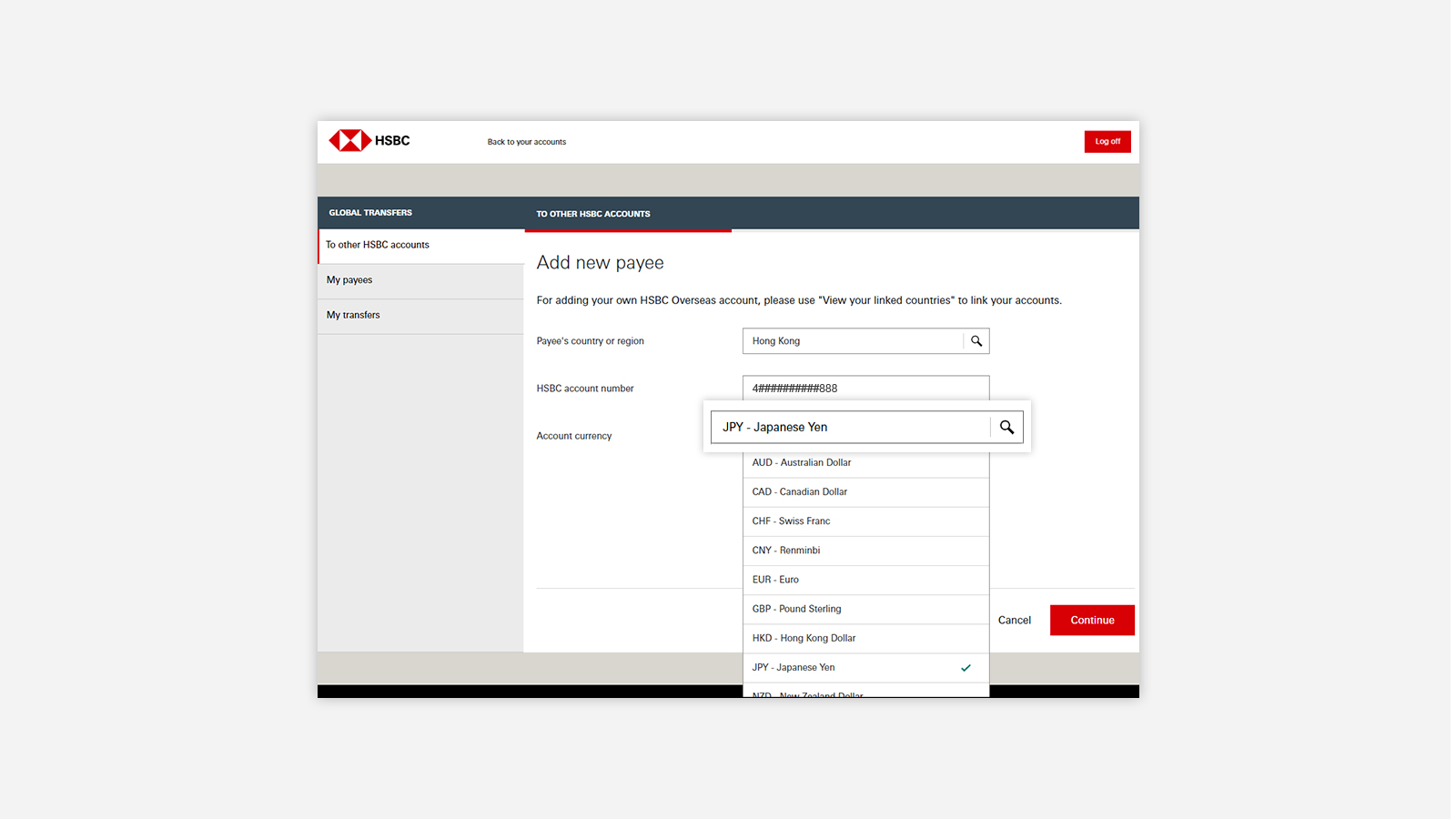

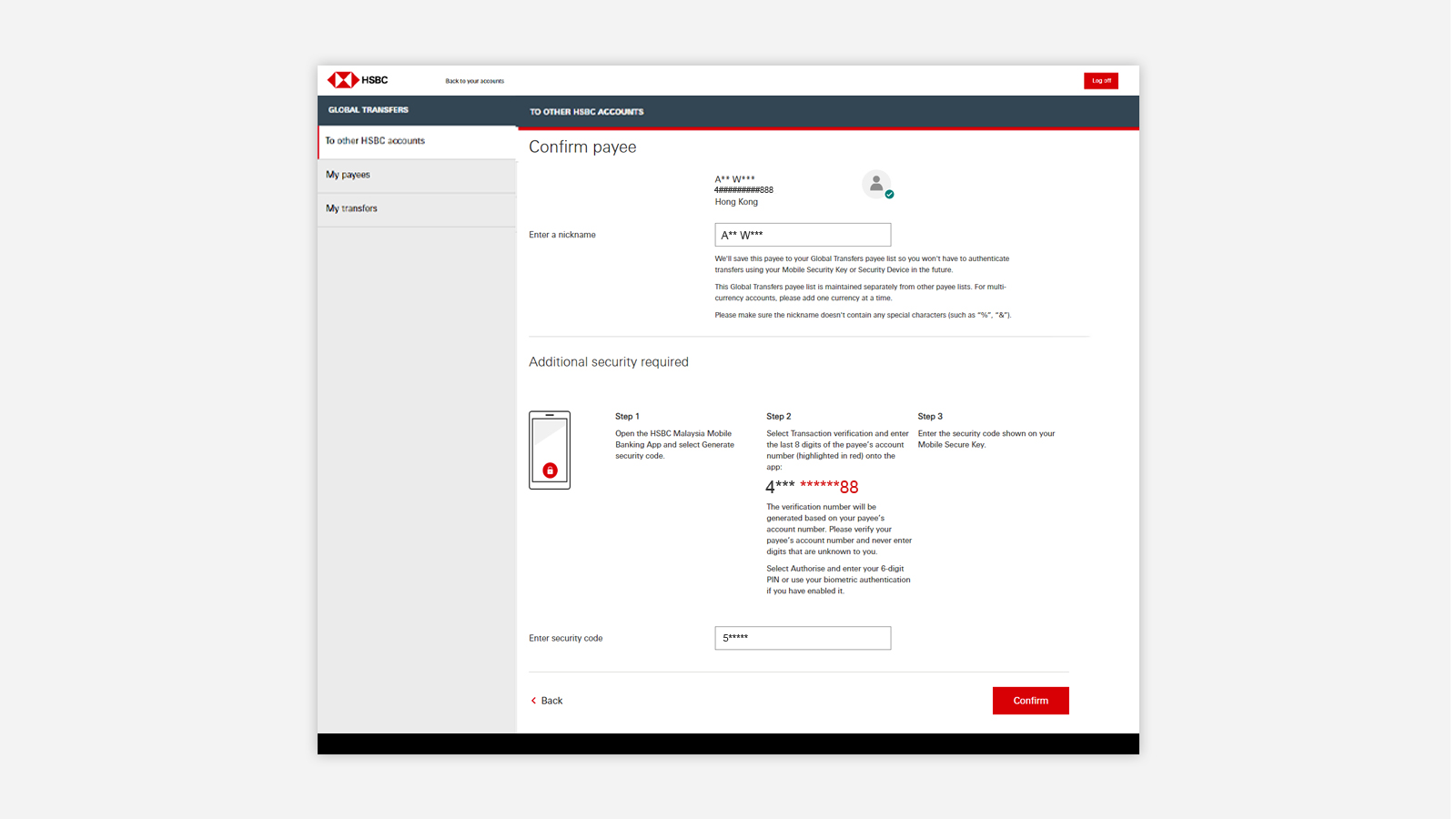

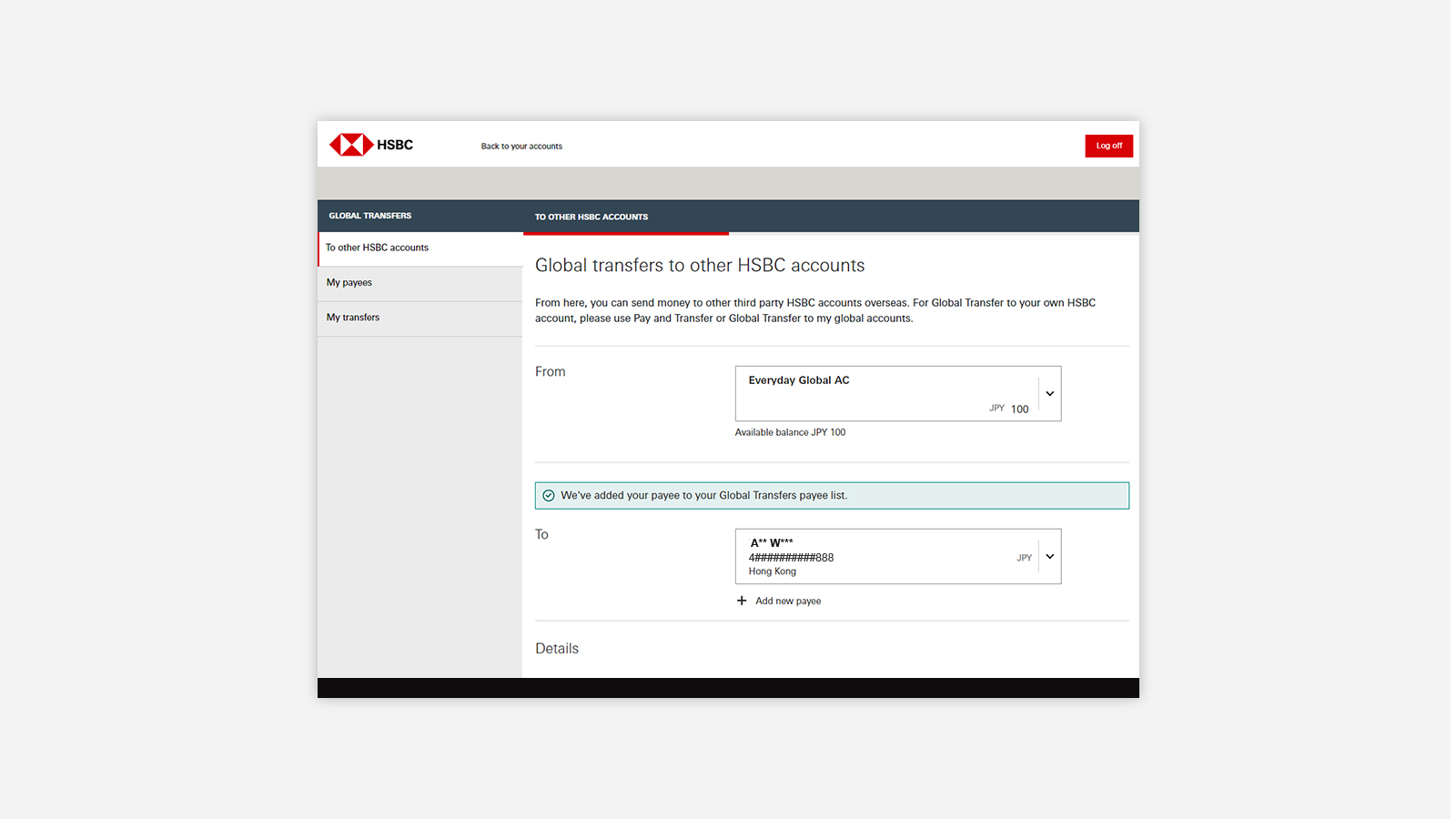

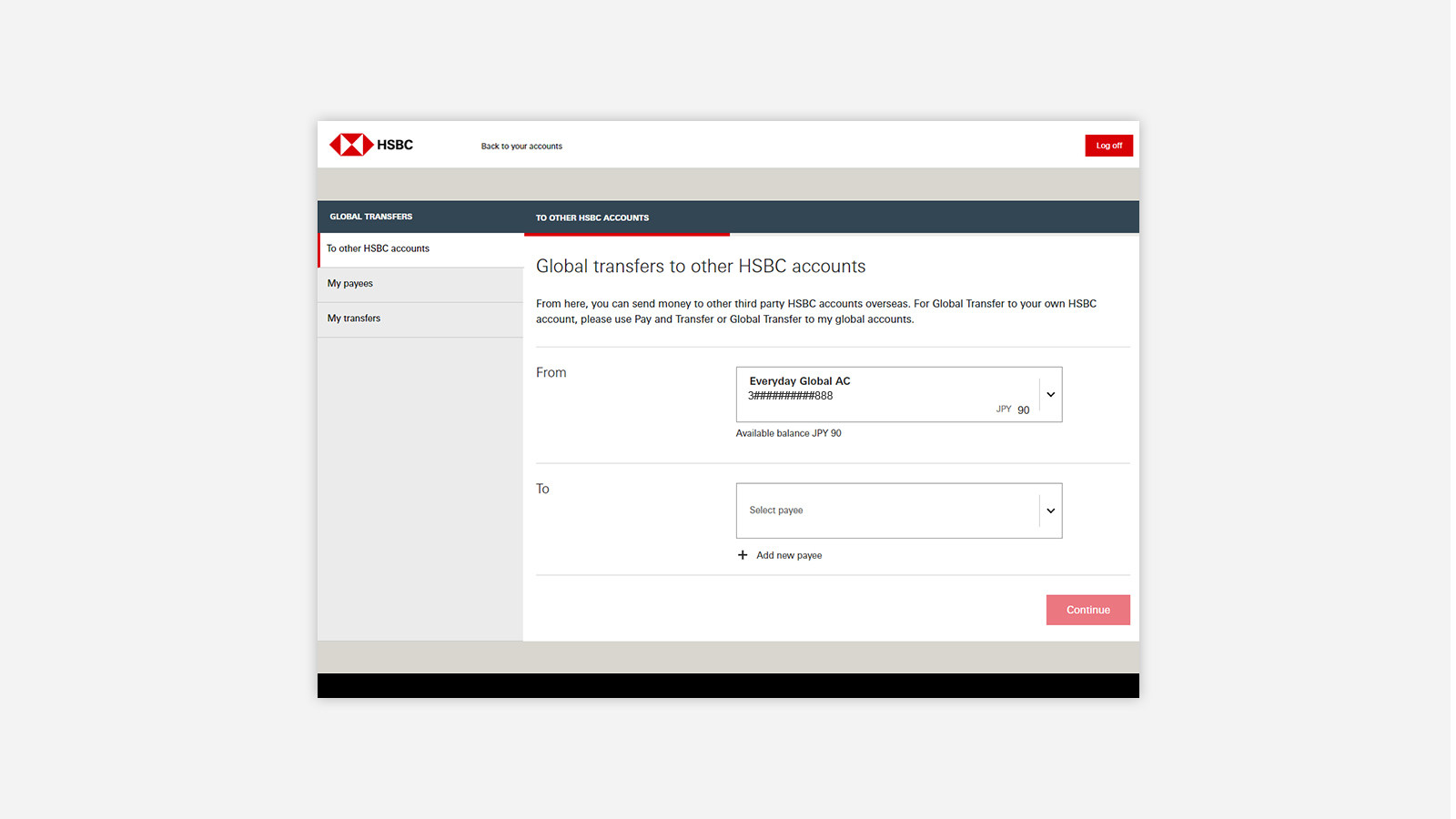

Global Transfers for family and friends (to third party HSBC accounts)

What is "Global Transfers for Family and Friends (GTFF)"?

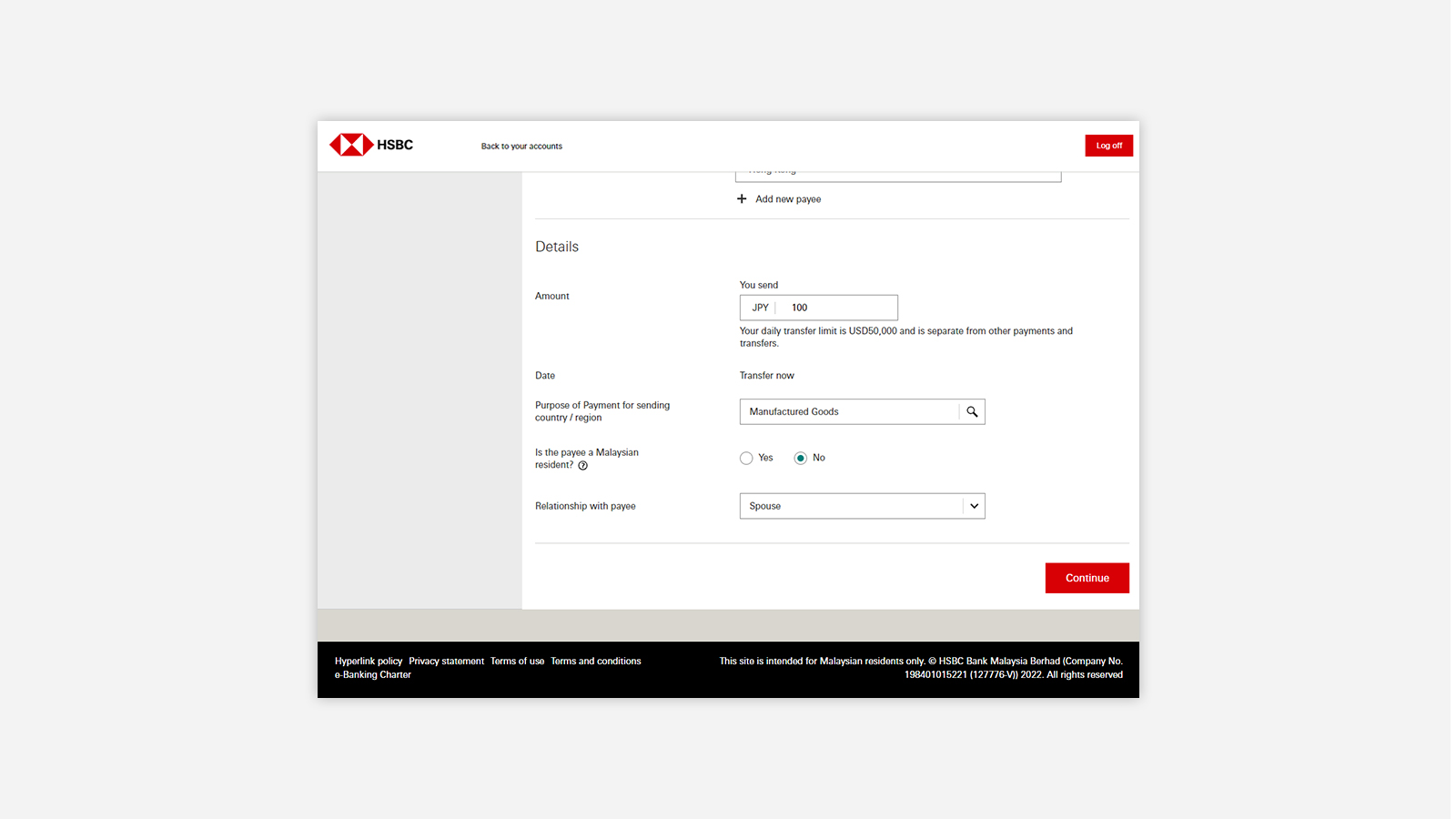

The "Global Transfers for Family and Friends" (GTFF) service allows HSBC Premier and Advance customers to make fund transfer to third-party HSBC personal accounts in overseas instantly via the Global Transfers feature. The service can be accessed in HSBC online banking by selecting "Global Transfers to other HSBC accounts".

FX rate alerts

What are FX rate alerts?

HSBC FX rate alerts allow you to track foreign exchange rate fluctuations and be notified when our rate hits your target rate.

Bank Negara Malaysia Foreign Exchange Policy

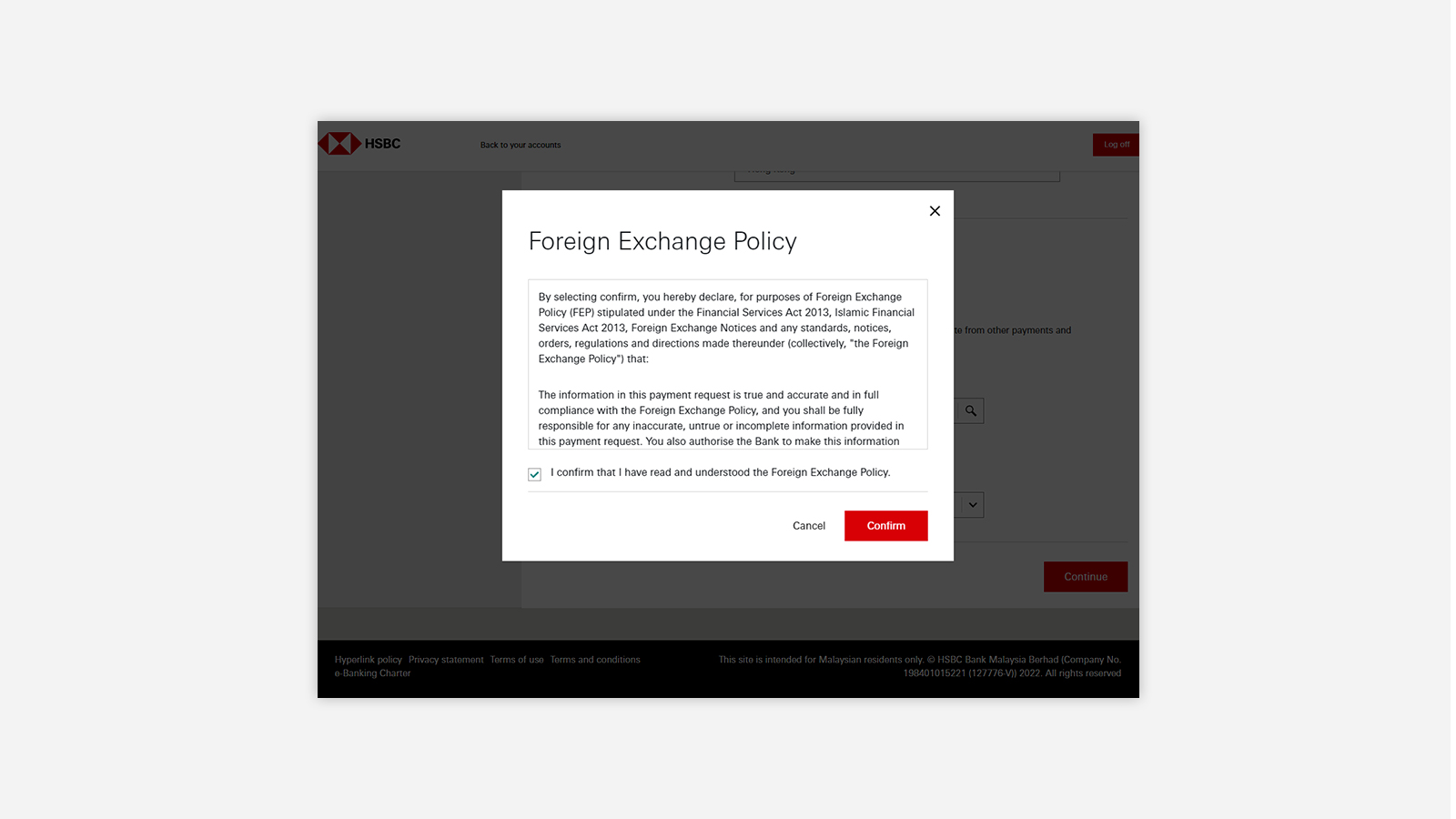

What is Bank Negara Malaysia’s (BNM) Foreign Exchange Policy (FEP)?

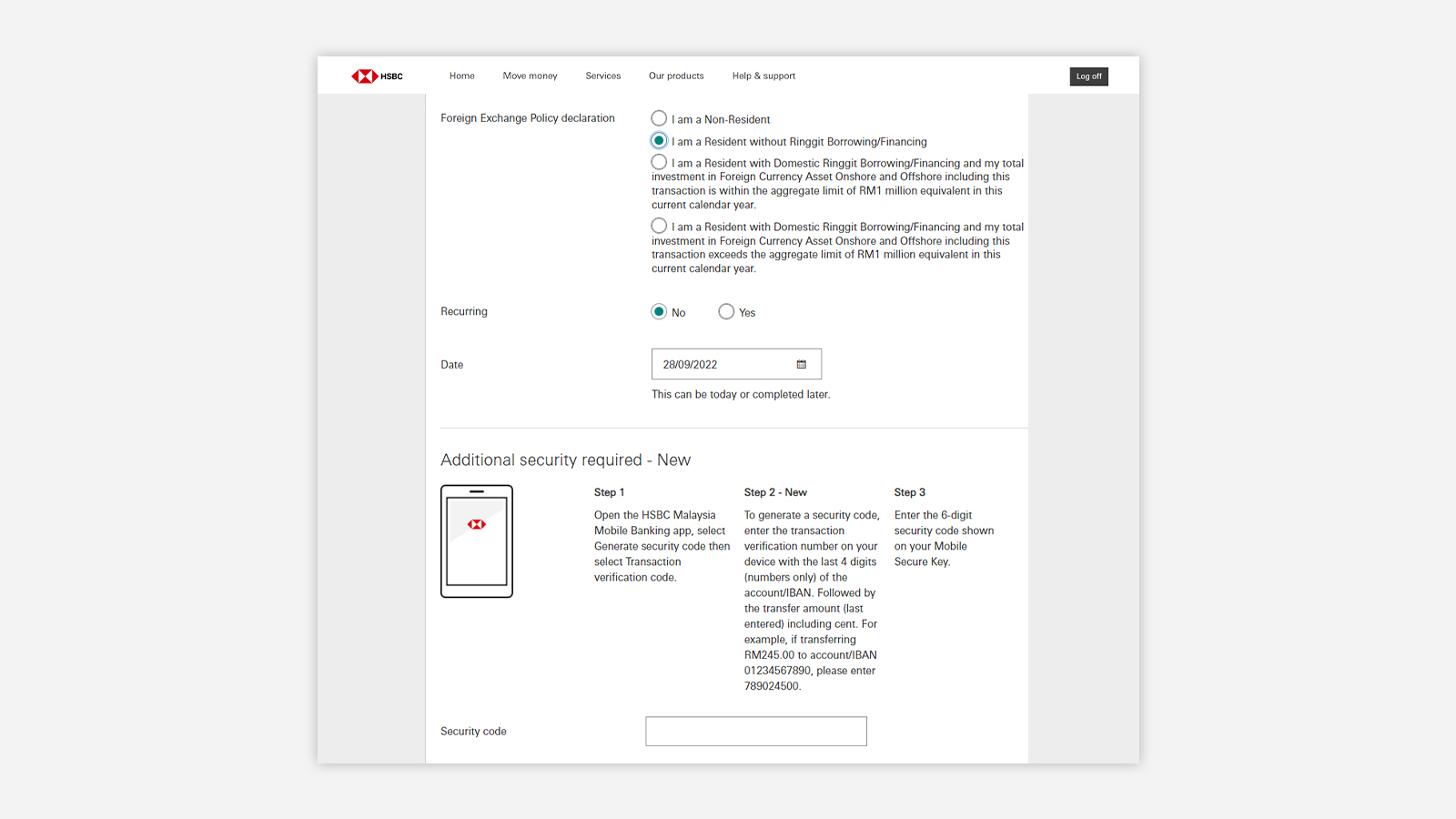

The FEP notices are administered by BNM under the Financial Services Act 2013 and Islamic Financial Services Act 2013 to speed up the development of the Malaysian financial market and to promote financial stability.

Depending on your residency status and whether you have domestic ringgit borrowing or financing, you may have a limit imposed on your investments in foreign currency assets onshore and offshore. To learn more about how the FEP may affect you, please read our full FAQ.